In its latest World Economic Outlook of July 2023, the International Monetary Fund (IMF) stated that global economy would continue to gradually recover from the pandemic and Russia’s invasion of Ukraine. Overall, the economy remained resilient in the first quarter of the year while labor markets stayed strong. Worldwide inflation pressures alleviated faster than anticipated driven by sharp drop in food and energy prices. As for the recent financial instability, it remained contained due to the forceful action of the authorities. However, signs of progress are undeniable in the near term.

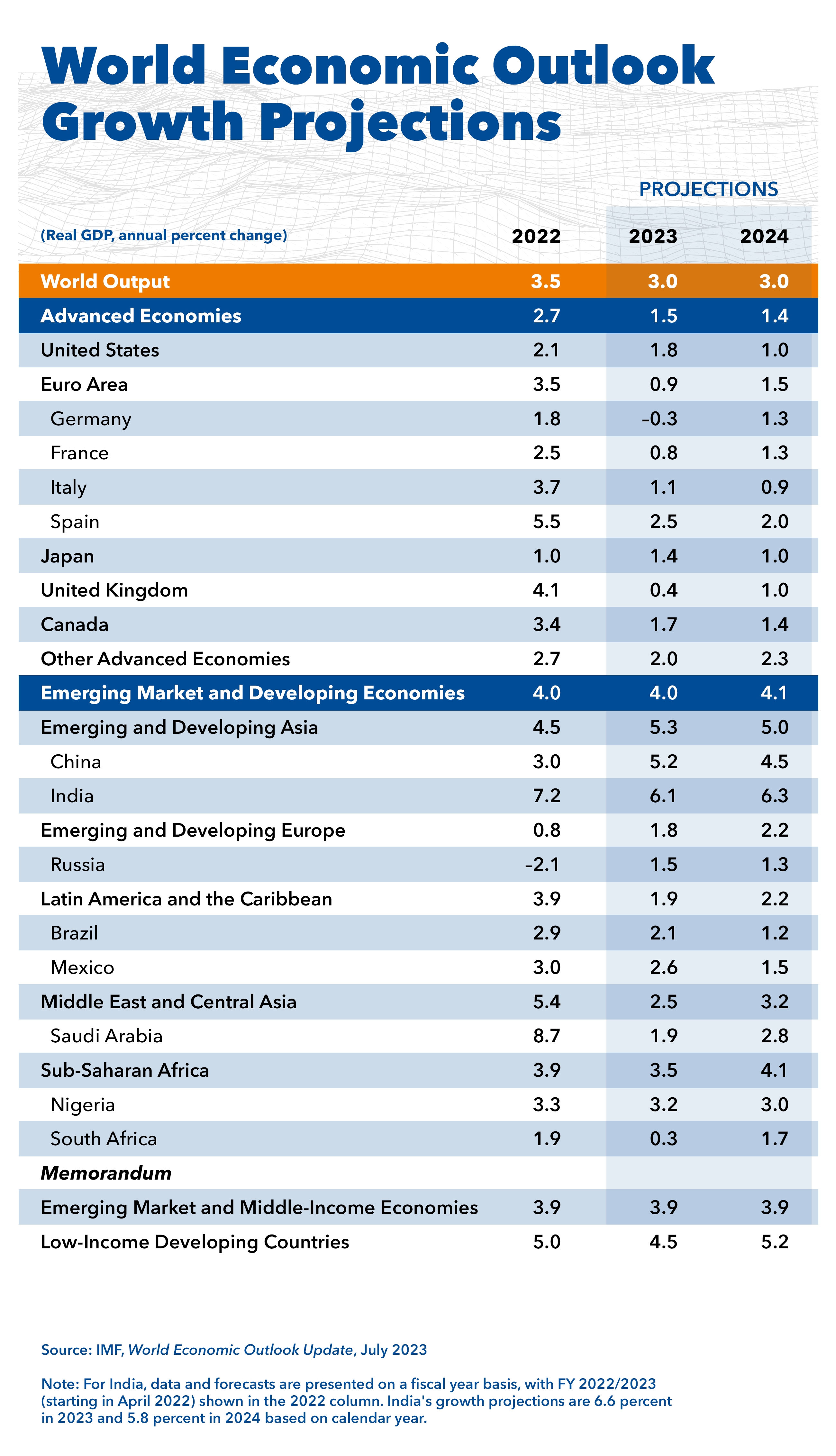

In numbers, IMF report stated that the global economic outlook for this year would be slightly brighter, but growth remains frail by slowing from last year’s 3.5% to 3% this year and next, a 0.2% upgrade for 2023 from April projections. Despite this slight improvement in economy, the world economy as a whole would be facing tight monetary policies with more increase in key interest rates by Central Banks to combat inflation. In fact, IMF projected global headline inflation to fall from 8.7% in 2022 to 6.8% in 2023 and 5.2% in 2024. Underlying core inflation is expected to decline more slowly and inflation forecasts for 2024 have been revised upwards and remained well above Central Banks’ targets.

The 2023 economic slowdown would be concentrated in advanced economies, in particular, Germany. Growth in advanced economies would fall from 2.7% in 2022 to 1.5% this year and remain subdued at 1.4% next year. The economy in the Euro area is set to decelerate sharply to 0.9% this year with Germany‘s forecast dropping to negative 0.3% this year. By contrast, growth in emerging markets and developing economies is still expected to pick-up with annual growth speeding up from 3.1% in 2022 to 4.1% this year and next. Meanwhile, emerging and developing Asia would grow strongly at 5.3% this year highlighting significant differences between the countries worldwide.

It is important to stress that tight monetary policies resulted in some of the slowdown in growth while rise of geo-economic fragmentation harmed most of the emerging and developing economies. Moreover, inadequate progress on the climate transition would leave poorer countries more exposed to increasingly severe climate shocks and rising temperatures. The outlook is still challenging and the touchdown may seem complex to execute but risks to inflation are now more balanced and most economies are less likely to need additional outsized increases in interest rates. All the while, Central Banks should monitor the financial system closely and maintain financial stability in the comping period.

Latest World Economic Outlook Growth Projections:

(Real GDP, annual percent change)

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.