Riad Salameh’s 30 year tenure just came to an end on July 31st 2023. At first, it was very unclear who was going to replace the central bank Governor as the government kept failing to elect a successor. There were rumors that Salameh’s term was going to be renewed until a replacement is found. Nonetheless, as per the law, the first deputy governor, Wassim Mansouri, took over Salameh’s dicey position.

Consequently, the controversial exchange rate platform known as Sayrafa, put in place by Salameh himself, also came to an end. The platform tried to help and stabilize the LBP to the USD as the parallel market exchange rates were soaring through the roofs. However, it was criticized as nontransparent, unsustainable, and inaccurate to the black market exchange.

The introduction of Sayrafa helped stabilize the black market LBP against the USD. In March 2023, Salameh intervened to inject money through the platform which managed to stabilize the LBP for almost than five months. This sense of stability helped a lot of businesses as they were able to better price their goods and services. However, this strategy of injecting money through Sayrafa was reported as very inefficient. BDL announced six interventions in the currency market through Sayrafa. According to the World Bank, they all had very minimal effects on the market exchange rate except for the most recent one. Based on their data, there was a very low correlation between interventions and the exchange rate.

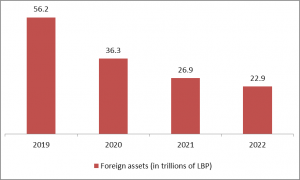

After the beginning of the economic crisis in 2019, foreign assets at BDL started dropping as a result of market interventions. In November 2019, BDL began subsidizing most products as the Lebanese people could not afford buying everyday necessities at regular prices, which explains the drop in foreign reserves from 2019 to 2021. In December 2021, Sayrafa was imposed. Instead of subsidizing products, the platform subsidized money (exchange rate). Overall, these measures created a big dent in BDL’s foreign assets. In four years, foreign reserves dropped by an astounding 33.3 trillion LBP.

Source: Banque du Liban

Sayrafa also affected regular citizens’ daily life. The rate is now used to price a lot of crucial services, such as phone bills, internet plans and electricity bills. That said, most people who earn a regular salary in LBP have to pay more money for these services any time the Sayrafa rate increases. A lot of people were forced to make lifestyle changes to better support themselves.

Sayrafa benefitted the Lebanese economy in some ways; however, it was like putting a Band-Aid on a bullet wound. Subsidizing aided the struggling community but BDL was subsidizing as though it had an infinite amount of money, which caused a huge drop in foreign reserves. If Sayrafa continued on there would reach a point when there would be no more money to pull from our foreign assets. This would shock the black market exchange, causing the value of the LBP to shoot back up again and become a floating (or flying!) exchange rate. All of the work and money put into Sayrafa to stabilize the exchange rate would be worth nothing. Therefore, it makes most sense to phase out Sayrafa slowly in order not to shock the economy and figure out stable and transparent alternatives to move the country forward.

Mansouri has been actively trying to rebuild BDL’s strategy regarding Sayrafa. He ordered to phase it out and aims to lift the peg on the local currency. He is also taking measures which state that the central bank “must completely stop financing the government outside of legal framework”. This raises some concerns as it risks compromising BDL’s independence. In central banking, monetary policy should be independent of political considerations. That said, economists believe BDL can refuse financing the government even if a law is passed to that effect. Mansouri also stressed that the government should undertake needed reforms. In the long term, Mansouri can hopefully keep Lebanon’s best interest in mind and slowly attempt to introduce the conditions and reforms the IMF set in place in 2020. This will also open the way for receiving external assistance that will most definitely help to fortify the country as a whole.

by: Yasmine Oueijan