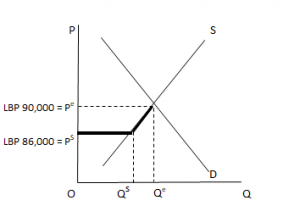

Diagram (1)

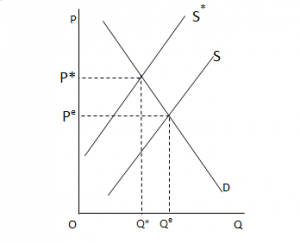

Diagram (2)

On August 1st 2023, as the term of BDL Governor Salameh expired, BDL (through the Acting Governor along with the other three Vice Governors) decided to suspend the Sayrafa FX market. The market used to supply a given amount of FX to the market daily, at a price of around 86,000 LBP per 1 USD and at an average quantity of $120 million for the month of July 2023.

The interesting thing, though, is that the Sayrafa price was less than the market price which stood at around 90,000 LBP. In economic terms, the 86,000 LBP price represented a price ceiling as BDL prices couldn’t go above it. We can express this graphically as in the supply and demand diagram (1) above: BDL supplied OQs of FX at the Sayrafa price OPs (86,000 LBP) whereas the market supplied the remaining quantity QsQe at the market price OPe (90,000 LBP). Total daily FX quantity stood at OQe; and effectively the supply schedule of FX was given by the bold line in the diagram.

The market dynamics would have definitely changed with the abolishing of the Sayrafa market. The effect of this policy would be to take away OQs of FX from the market, which would translate to a reduction in the FX supply schedule by the same magnitude from S to S* in diagram (2). The resulting impact of this leftward shift in FX supply is to increase the market price to OP* and reduce market quantity to OQ*.

The surprising thing is that for the month of August 2023 the market price has stood at the same price OPe of around 90,000 LBP per USD. Why has theory then not agreed with reality? We will propose three suggested answers:

All that, along with expected critical developments, should make for an interesting month of September 2023.