Arab nations have a historical trajectory of establishing contemporary financial sectors. Despite variations among these countries, the region has effectively embraced economic and financial reforms to foster economic growth and stability. Presently, as the world recuperates from the pandemic, the Arab countries are navigating the future of their financial development. While progress was being made to recover from the pandemic’s aftermath, the emergence of the Ukrainian conflict posed a new hurdle. This, coupled with rising energy and commodity prices, disrupted global supply chains and endangered food security worldwide. The impact on the Arab countries’ financial sector hinges on their individual economic compositions. The report, “Financial development in the Arab Region: Progress and Challenges” by the Union of Arab Banks (2023), analyses recent advancements in the Arab region’s financial development and envisions future reforms and suggestions. Financial development is primarily characterized by access to financial services, institutional efficiency, capital market activity, and market depth. This study aims to evaluate the evolution of Arab countries’ financial institutions, gauging their depth, accessibility, efficiency, and addressing challenges faced over the years.

Indeed, the Arab financial market was significantly impacted by the Covid-19 pandemic. Many stock exchanges also documented unanticipated losses due to the drop in the share prices of major listed companies. Two years after the onset of Covid-19, during which the region faced significant challenges due to the pandemic and began implementing recovery measures, the Arab financial markets saw a decrease of approximately 3.3% by the end of 2022. This represented a year-on-year drop of roughly 4.6% compared to the end of the fourth quarter of 2021. Thankfully, by the close of the first quarter in 2023, the AMF composite index for Arab financial markets documented a positive uptick of 0.8%, as compared to the fourth quarter of 2022. Nonetheless, this was accompanied by a year-on-year decrease of approximately 3.5% when compared to the end of the first quarter in 2022.

The financial stress faced by advanced economies has limited spillover to Arab region banks, although the region’s financial markets have generally followed global trends. However, risks remain, including potential disruptions to credit conditions that could impact global growth and financial market volatility, as well as increased volatility in commodity markets due to events like the war in Ukraine, potentially leading to inflationary costs and social unrest in the MENA region.

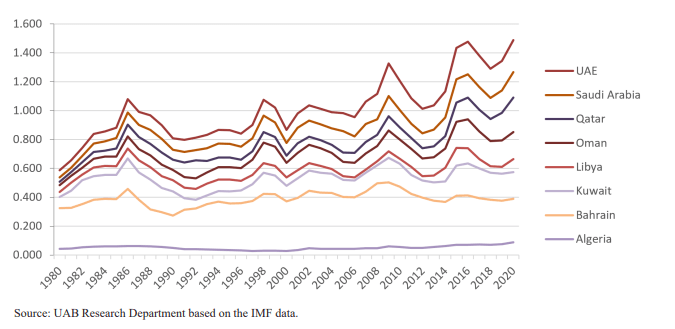

An analysis of financial development progress across 18 Arab countries revealed various categories: Oil Exporters (OE), Emerging Market and Middle-Income Countries (EM&MI), and Low-Income Developing Countries (LIC). The UAE and Saudi Arabia exhibited relatively strong financial institution depth, while other OE countries showed similar trends. Financial institution access within economies was crucial for development, with UAE leading in this area and Saudi Arabia lagging. Qatar stood out in financial access due to strategic efforts by its central bank and development bank.

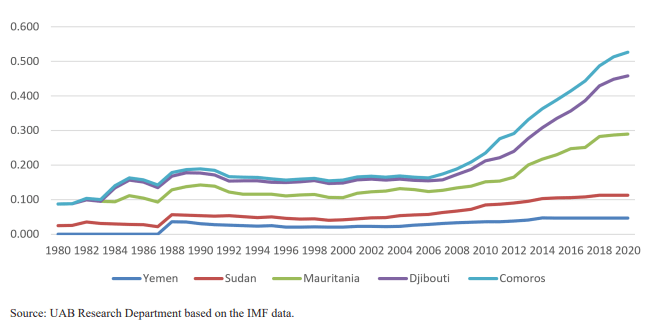

Moreover, efforts to expand financial inclusion, especially after the Arab Spring, led to increased financial access and depth, but challenges persist in low-income Arab countries due to conflict and external shocks. Financial institution efficiency remained stable across the Arab countries, with OE countries showing higher efficiency.

Figure 1: Financial Institutions Depth Scores in the Arab oil exporting countries

Figure 2: Financial Institutions Access in the Arab low income Countries

In conclusion, Arab financial development showed progress over the years, driven by capital market improvements, Islamic finance, and economic reforms. However, challenges including geopolitical tensions, diverse financial systems, political unrest, and external shocks impact advancement. Despite these challenges, progress continues with the adoption of reforms, digital transformation, and efforts to attract foreign investment. However, hindered access to financing for SMEs, inadequate financial literacy and inclusion, and the need for multiple reforms remain obstacles to overcome.