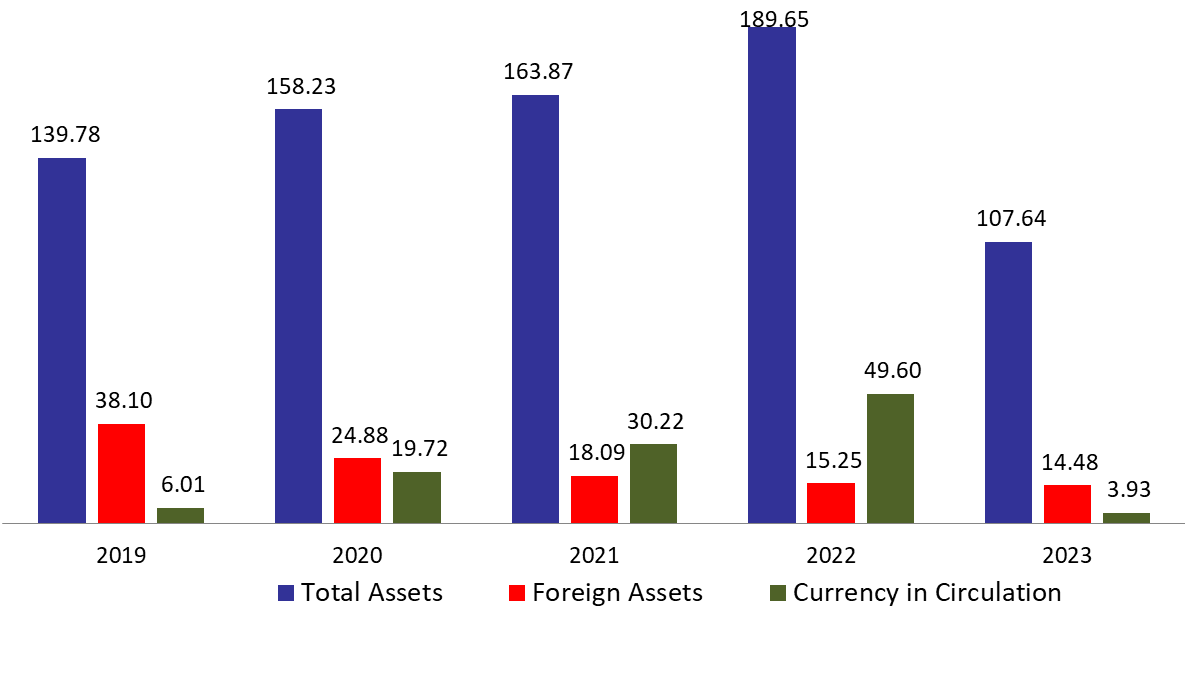

According to the balance sheet of Banque du Liban (BDL), the central bank’s total assets fell by 43.24% compared to last year, to reach $107.64B by mid of December 2023, amid adopting the 15,000 LBP/USD official rate by BDL since February 2023. The fall was mainly due to the 91.82% year-on-year (YOY) drop in other assets, grasping 7.10% of BDL’s total assets and reaching $7.64B mid of December 2023. Furthermore, the gold account, representing 17.50% of BDL’s total assets, increased by 14.98% yearly to reach $18.83B by mid of December 2023.

Furthermore, BDL’s foreign assets, consisting of 13.45% of total assets dropped by 5.06% YOY and stood at $14.47B by mid of December 2023, noting that BDL holds in its foreign assets $5B in Lebanese Eurobonds. Interesting to note that foreign assets increased by $199.78M in the first two weeks of December 2023 and increased by $690.70M since end of July 2023.

On the liabilities front, financial sector deposits, representing 82.65% of BDL’s total liabilities, decreased by 16% and reached $88.96B by mid of December 2023 compared to last year, of which more than 90% are denominated in dollars. Lastly, currency in Circulation outside of BDL, consisting of 3.65% of BDL’s total liabilities, plunged by 92.08% annually to reach $3.92B by mid of December 2023 amid adopting the 15,000 LBP/USD official rate by BDL.

BDL Total, Foreign assets and Currency in Circulation by Mid of December 2023 ($B):

Source: BDL, Blominvest

Disclaimer

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.