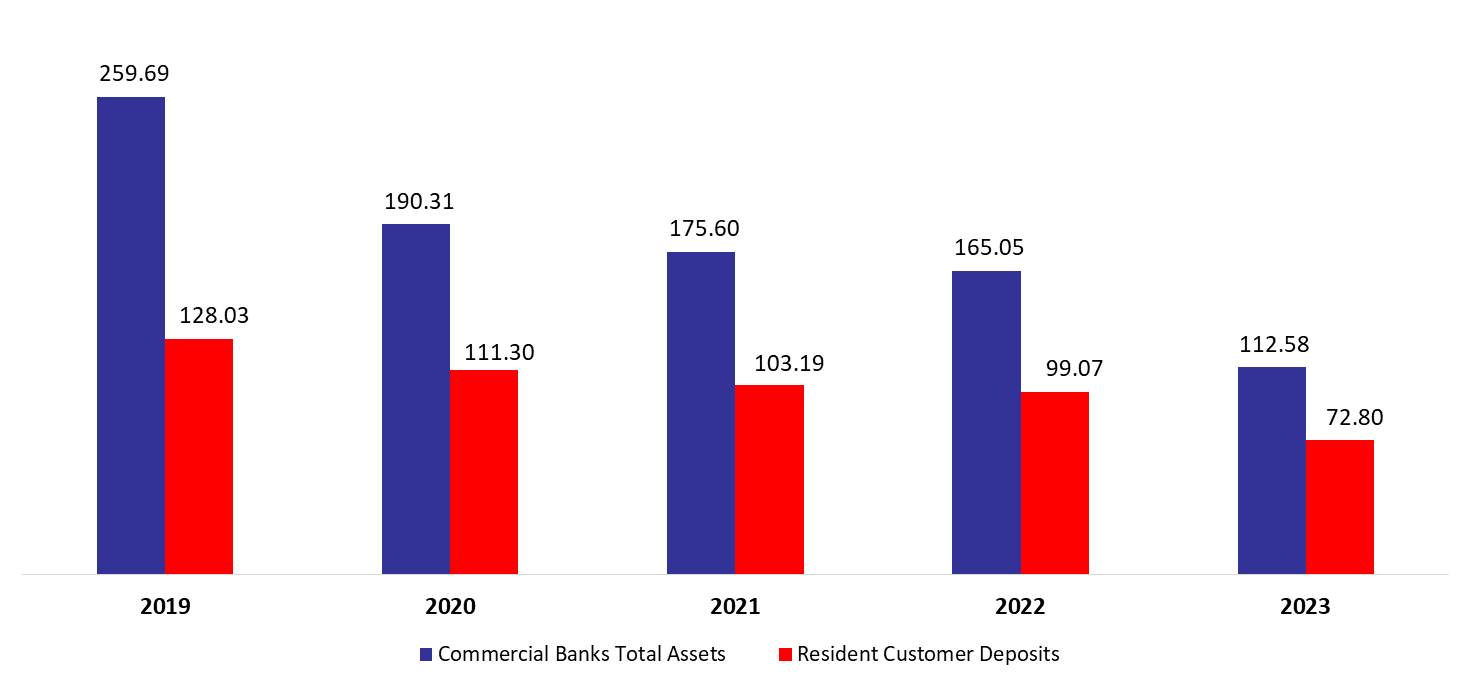

According to Lebanon’s consolidated commercial banks’ balance sheet, total assets decreased annually by 31.79% to stand at $112.58B by November 2023 amid BDL’s adoption of a new exchange rate of LBP 15,000 per USD.

On the assets side, currency and deposits with Central Bank represented a high figure of 74.95% of total assets; they dropped annually by 22.43% to settle at $84.37B in November 2023. Deposits with the central bank (BDL) represented 99.28% of total reserves, and decreased by 20.87% YOY, to reach $83.77B in November 2023. Furthermore, Vault cash in Lebanese pound fell by 79.2% on a yearly basis to stand at $605.91M by the same period. The drop is attributed to the calculation based on the new official exchange rate of LBP 15000 per USD.

Claims on resident customers, constituting 6.52% of total assets, shrank significantly by 61.2%, to stand at $7.34B in November 2023. Moreover, Resident Securities portfolio (4.97% of total assets) dropped by 61.53% in November 2023 to stand at $5.59B. More specifically, the Eurobond holding recorded a decline of 29.99% since November 2022, to reach $2.41B by end of November 2023. Additionally, claims on non-resident financial sector increased by 4.82% YOY to stand at $4.31B by November 2023.

On the liabilities side, resident customers’ deposits were the main account, representing 64.67% of total liabilities; they decreased by 26.51% since November 2022 to reach $72.8B by the month of November 2023. In more details, deposits in foreign currencies (95.4% of resident customers’ deposits) decreased by 5.99% YOY to reach $69.46B by November 2023, additionally deposits in LBP (4.6% of resident customers’ deposits) fell by 86.72% YOY to stand at $3.35B by November 2023. Noting that Lebanon has become dollarized and cash based.

As for Non-resident customers’ deposits, grasping 18.82% of total liabilities, they recorded a drop of 9.54% and stood at $21.18B in November 2023. In details, the deposits in LBP fell by 90.35% to reach $192.01M and deposits in foreign currencies declined by 2.03% to reach $20.99B over the same period. In addition, Non-resident financial sector Liabilities held 2.69% of total Liabilities and decreased by 29.92% YOY to reach $3.02B in November 2023. More importantly, the dollarization ratio for private sector deposits increased from 77.41% in November 2022 to 96.12% in November 2023.

Commercial Banks Assets and Residents Customer Deposits by November 2023 ($B)

Source: BDL, BLOMINVEST

Disclaimer:

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.