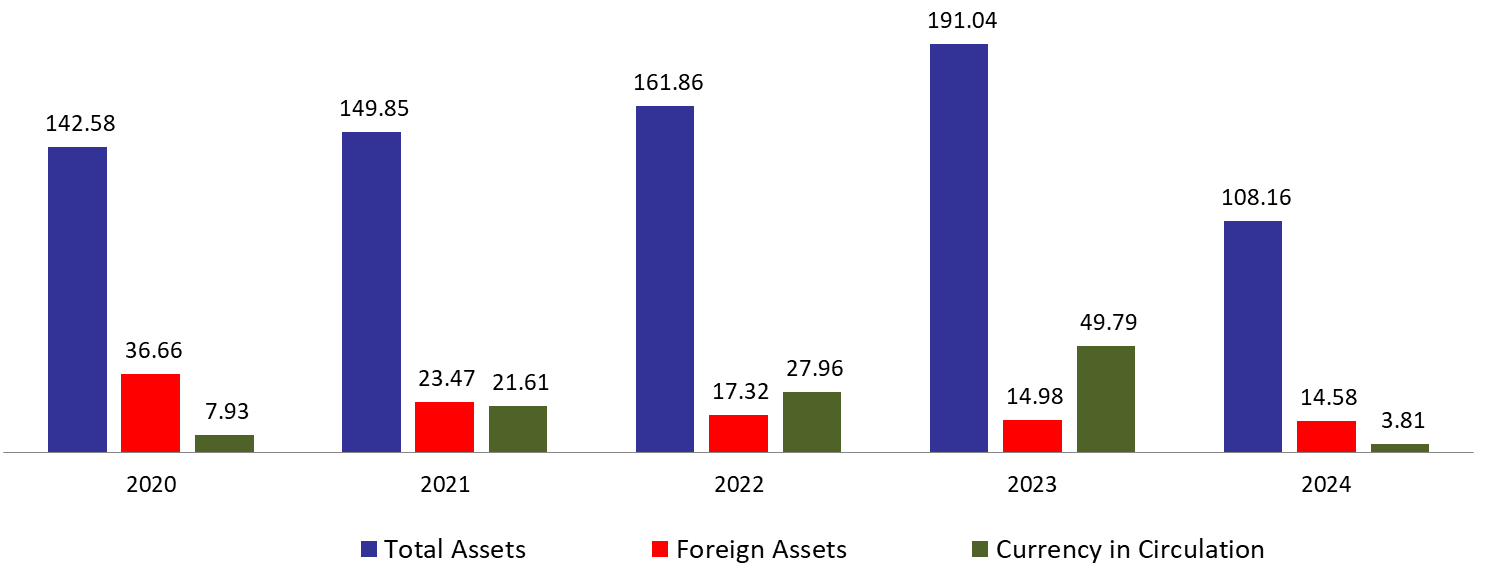

According to the balance sheet of Banque du Liban (BDL), the central bank’s total assets fell by 43.38% compared to last year, to reach $108.16B by end of January 2024, amid adopting the 15,000 LBP/USD official rate by BDL since February 2023. The fall was mainly due to the 99.6% year-on-year (YOY) drop in other assets and reached $376M by end of January 2024 compared to 94,466M by January 31, 2023. Interesting to mention that based on Central Council decision number 23/36/45 dated 20/12/2023, all previous Central Council decisions related to Seigniorage were suspended and all deferred interest costs emanating from open-market operations were presented under a new line item. As a result, all deferred interest costs included in Other Assets and Assets from Exchange Operations amounting to LBP 118.97 Trillion as of 31/12/2023 were transferred to “Deferred Open-Market Operations”.

Furthermore, the gold account, representing 17.37% of BDL’s total assets, increased by 6.95% yearly to reach $18.79B by end of January 2024. Additionally, BDL’s foreign assets, consisting of 13.48% of total assets dropped by 2.69% YOY and stood at $14.58B by end of January 2024, noting that BDL holds in its foreign assets $5B in Lebanese Eurobonds.

On the liabilities front, financial sector deposits, representing 82.24% of BDL’s total liabilities, decreased by 16.63% and reached $88.95B by end of January 2024 compared to last year, of which more than 90% are denominated in dollars. Lastly, currency in Circulation outside of BDL, consisting of 3.52% of BDL’s total liabilities, plunged by 92.36% annually to reach $3.81B by end of January 2024 amid adopting the 15,000 LBP/USD official rate by BDL.

BDL Total, Foreign assets and Currency in Circulation by end of January 2024 ($B):

Source: BDL, Blominvest