Global remittances to low- and middle-income nations (LMICs) reached $669 billion, growing annually by 3.8% but falling short of previous years’ gains. This is in the main due to resilient labour markets in advanced economies and Gulf Cooperation Council (GCC) nations, which continued to support migrants by sending money back home. Nevertheless, concerns arise regarding the potential decline in real income for migrants in 2024, amidst global inflation and subdued growth prospects, as highlighted in the latest Migration and Development Brief 2023 released by the World Bank.

Regionally, remittance inflows saw growth in Latin America and the Caribbean (8%), South Asia (7.2%), East Asia and the Pacific (3%), and Sub-Saharan Africa (1.9%), while the Middle East and North Africa experienced a decline for the second consecutive year (-5.3%), primarily attributed to a sharp decrease in remittances to Egypt. Remittances to Europe and Central Asia also decreased (-1.4%).

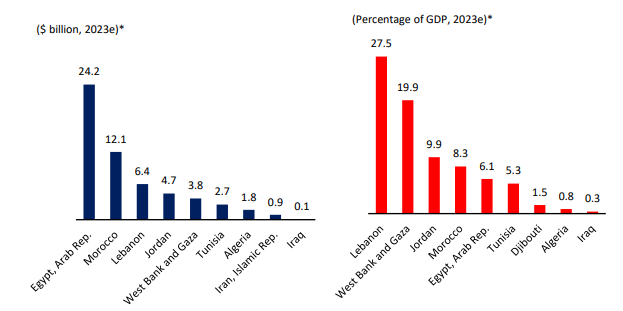

The United States remained the largest source of remittances, with the top five recipient countries being India, Mexico, China, the Philippines, and Egypt. Notably, remittance inflows are significant in relation to the gross domestic product (GDP) of several economies, including Lebanon, the West Bank and Gaza, and Jordan. In Lebanon, remittance receipts represent 27.5% of GDP and account for more than 80% of the aggregate of external resource flows (sum of remittances, FDI, and ODA). Lebanon remains the most vulnerable economy in the region as the country is facing debt restructuring, hyperinflation and a sharp devaluation of its currency. Unfortunately, the country remains without reform plans since 2019 and without a Head of State since end of October 2022.

Looking ahead, weaker global economic activity is expected to further soften the growth of remittances to LMICs, projected at 3.1% in 2024. Factors such as slowing economic growth, weaker job markets in high-income countries, volatile oil prices, and currency exchange rates pose additional downside risks.

Finally, although remittance costs are elevated- averaging 6.2% for sending $200- remittances remain a crucial source of private external finance. Furthermore, they are expected to continue to grow in the coming years. Remittances in some regions are influenced by factors such as labour market conditions, exchange rates, and geopolitical developments. However, remittances continue to serve as a lifeline for millions, contributing in net terms to economic resilience and development worldwide.