According to the Central Administration of Statistics (CAS), the Consumer Price Index (CPI) displayed continuing rise in inflation rates since the end of 2019. When observing 2022 & 2023 rates, we notice the high year-over-year change in Consumer Price Index (CPI). It is interesting to note that all sectors witnessed inflationary pressure during the last four years. Generally, in stable countries, there are several reasons for inflation such as increase in wages, increase in the prices of raw materials, increase in taxes, decrease in production and increase in money supply. Unfortunately, all the aforementioned causes exist simultaneously in Lebanon accompanied with the two main reasons for the extraordinary inflation: deterioration of the Lebanese currency and almost full dollarization of the country.

The government has provided public sector employees a rise in salaries in LBP several times in order to end their strike due to the devalued wages after the deterioration of the Lebanese Pound on the parallel market which became insufficient to cover their basic needs. Also, the global high inflation rate, the war between Russia and Ukraine and the war in Gaza increased the prices of raw material that affected all countries including Lebanon that was already facing economic and financial problems. Moreover, Port of Beirut and customs tariffs skyrocketed after being dollarized. In addition, the taxes imposed by the government were increased in multiple folds in order to cover the operational expenses of the public sector.

Furthermore, the currency in circulation increased at a rapid pace since 2019 as shown in the below table, in order to cover the depositors’ withdrawals from their USD deposits as per BDL circular 151. This reveals the escalation of CPI along with the increase in currency in circulation.

| Month | Consumer Price Index (CPI) | Currency in Circulation (in Billions of LBP) |

| Dec 2019 | 115.54 | 9,817.6 |

| Dec 2020 | 284.04 | 29,242.1 |

| Dec 2021 | 921.40 | 41,514.8 |

| Dec 2022 | 2,045.46 | 73,513.9 |

| Nov 2023 | 5,976.83 | 47,459.6* |

*Such decrease in currency in circulation is due to the BDL’s new strategy to withdraw currency in circulation to prevent the increase in the USD/LBP exchange rate. However, this didn’t decrease inflation due to the almost full dollarization of the country.

| Annual Inflation by Category | Dec 2021 – Dec 2022 | Dec 2022 – Dec 2023 |

| Food and Non-alcoholic Beverages | 142.94% | 207.60% |

| Housing water, electricity, gas and other fuels | 52.88% | 206.71% |

| Health | 167.46% | 173.59% |

| Transportation | 127.22% | 123.88% |

| Communication | 311.86% | 128.83% |

| Education | 191.35% | 595.18% |

| Consumer Price Index (CPI) | 121.99% | 192.26% |

In terms of product category, Communication sector witnessed the highest inflation rate in 2022 mainly due to the amendment of telecommunication tariffs pricing from USD/LBP exchange rate of 1,500 to Sayrafa exchange rate (USD 1 = LBP 25,300 at that time) starting July 1, 2022. Moreover, Education sector witnessed the second highest inflation rate of 191.35% due to the fact that most if not all private schools and universities issued part of the 2022/2023 tuition fees in USD (banknotes) and the other in LBP at Sayrafa exchange rate.

When it comes to 2023, the Education sector earned the first place in inflation rate as it recorded 595.18%. The reason behind this extraordinary inflation rate is that the majority of the private schools and universities issued the 2023/2024 tuition fees mainly in USD (banknotes). Second came Food and Non-alcoholic beverages with annual inflation rate of 207.60% due to the war in the region and escalating conflicts at the Bab El Mandeb Strait, being a vital global maritime passageway that resulted in disruption of supply chain, an upturn in shipping costs, and consequently elevated consumer prices including Food and Non-alcoholic beverages.

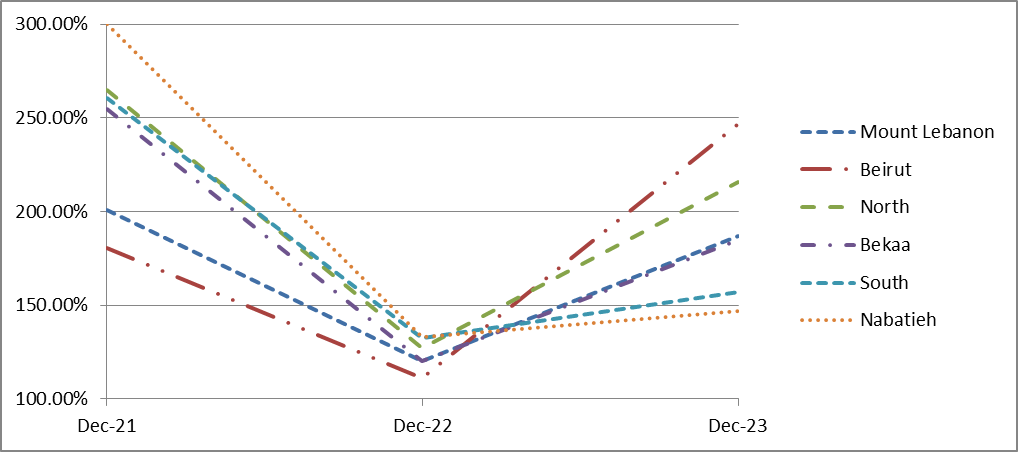

When looking at the breakdown by region, the inflation rates are as follows:

| CPI by Region | Dec 2021 – Dec 2022 | Dec 2022 – Dec 2023 |

| Mount Lebanon | 119.99% | 186.70% |

| Beirut | 111.19% | 246.78% |

| North | 127.09% | 215.99% |

| Bekaa | 120.26% | 184.99% |

| South | 132.34% | 157.21% |

| Nabatieh | 132.86% | 147.00% |

As per the above table and graph, inflation rates decreased in 2022 in all governorates compared to 2021 and then increased in 2023. In 2022, Nabatieh and South governorates recorded the highest inflation rates of 132.86% and 132.34% respectively and this is due to the increase in food and non-alcoholic beverages and transportation costs.

In 2023, Beirut recorded the highest inflation rate and this is attributed to the increase in education costs mainly due to the fact that most expensive private schools and universities are located there and also to increase in transportation costs and food and non-alcoholic beverages.

In conclusion, the continuing increase in taxes, that mainly affects the middle and low income people the most, in order to cover the operational costs of the public sector, and the absence of financial and economic reform plans will keep the high inflation rates in Lebanon in the coming years.

Disclaimer :

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.