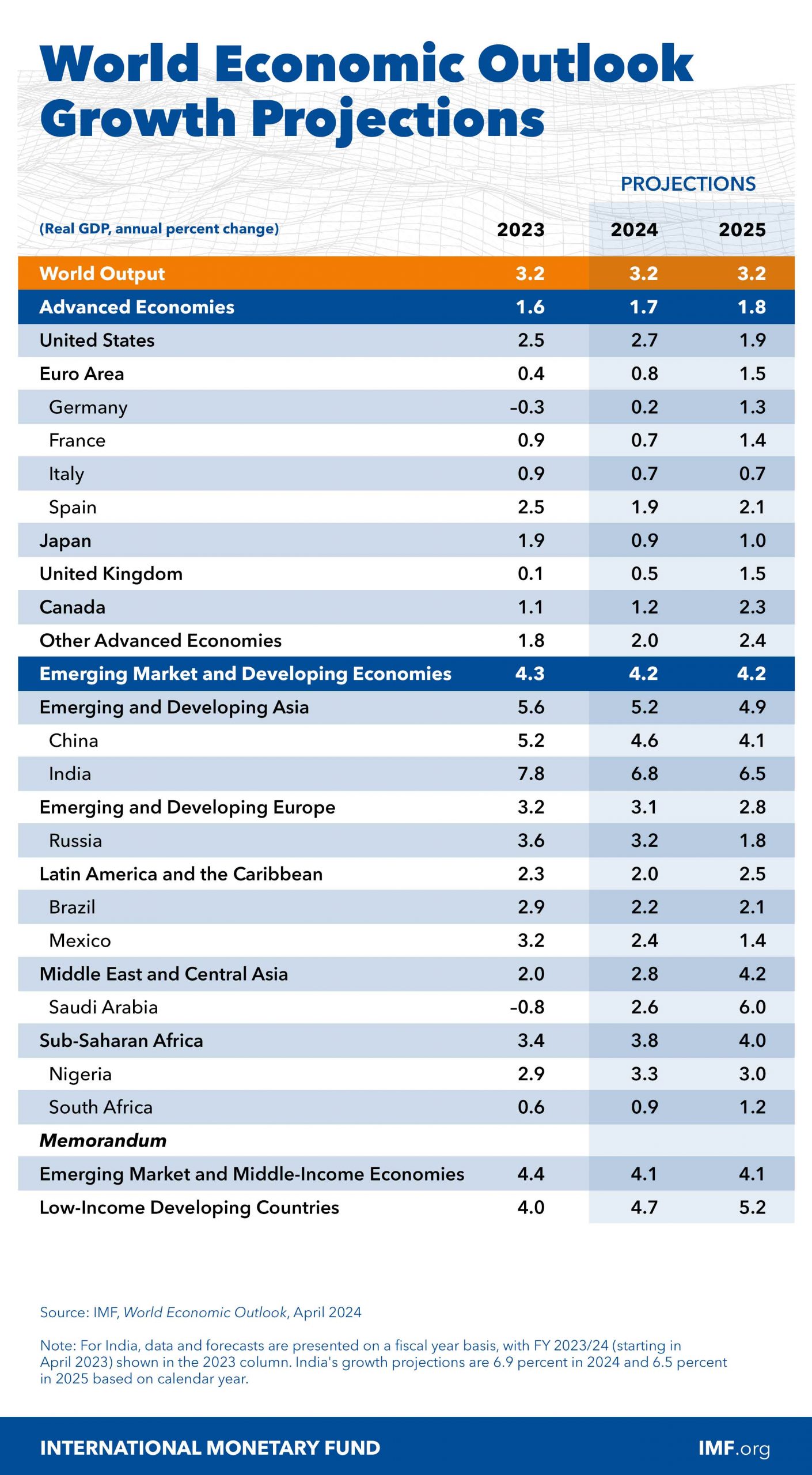

The International Monetary Fund (IMF) updated its World Economic Outlook (WEO) projections on April 16, 2024 concerning (i) GDP growths and inflation worldwide, (ii) scarring from the crisis, (iii) monetary calibration, (iv) fiscal adjustment needs, and (v) improvements in monetary and fiscal policy frameworks.

As per this latest update, the global economy is showing steady growth in GDP and drop in inflation after few hard years starting with the supply-chain distractions triggered by Covid-19 pandemic, and energy and food crisis fueled by the Russian-Ukrainian war. This caused a substantial surge in inflation and was combatted by monetary policy tightening globally in a harmonized fashion.

During 2022, global median inflation rate increased significantly and reached 9.4% at the end of the year while global growth recorded 2.3%. As per IMF latest WEO projections, growth will record 3.2% in both 2024 & 2025 while inflation rate will record 2.8% by the end of 2024 and will drop to 2.4% by the end of 2025.

As such, IMF estimates of scarring from crisis altered downward for most countries except for Low-Income Developing Countries (LIDC) which are still battling to return to pre-pandemic and cost-of-living crisis levels.

The resilient growth and speedy drop in inflation, as a result of monetary policy actions, show favorable supply developments involving the decline in energy prices shocks and a noticeable recovery in labor supply due to robust immigration in many advanced countries.

Despite the above mentioned decent projections, there are still numerous challenges needed to be tackled through various decisive actions.

Even though inflation trends are promising and moving ahead toward target rates, the decline was stalled since the beginning of 2024. The previous decrease in inflation rates was mainly due to the decrease in energy prices and goods inflation. The latter dropped because of decline in the prices of Chinese exports as well as relieving supply chain struggles. However, oil prices have been escalating recently after the geopolitical tensions and goods inflation is expected to be driven up due to trade restrictions on Chinese exports.

Despite the fact that United States’ recent data displays robust productivity and employment growth, there is a strong demand for goods in an economy that remains overheated. This issue is making Federal Reserve’s members prudent regarding the timing of the monetary policy easing.

In the Euro zone, growth will bounce from very low levels after past shocks and tight monetary policy. However, the European Central Bank (ECB) must be cautious in monetary easing in order to avoid an inflation undershoot. Regarding the strong labor market, it might prove deceptive if European firms have been hoarding labor in hope of a rise in activity that does not materialize.

When it comes to China, the recession in its property and related activities sector in addition to the depressed domestic demand are affecting its economy. Regarding other large emerging markets economies, they are benefitting from the trade tension between the United States and China that lead to a reconfiguration of global supply chain.

Having said that, policymakers’ priority must be preserve and improve the resilience of the global economy through rebuilding fiscal buffers. Credible fiscal consolidations might aid in lowering funding costs and improve financial stability whilst the sustained high real interest rates which made sovereign debt dynamics less favorable. Even though fiscal consolidations are tough, it is preferable to be done early before the market dictates its own conditions. Unfortunately, due to a record number of elections in 2024 (United States, United Kingdom, India and South Africa to name a few), the inadequate fiscal plans are expected to be disrupted further.

Another priority is to reverse the medium-term declining growth prospects that are triggered by inefficient resource allocation. For LIDCs, it should work on developing the human capital of their hefty young population. Moreover, LIDCs must apply structural reforms in order to attract domestic and foreign direct investments which will lead to a lowered borrowing costs and funding needs. In addition, countries have to enhance their digital infrastructure and invest in human capital in order to apply artificial intelligence that might hopefully boost productivity.

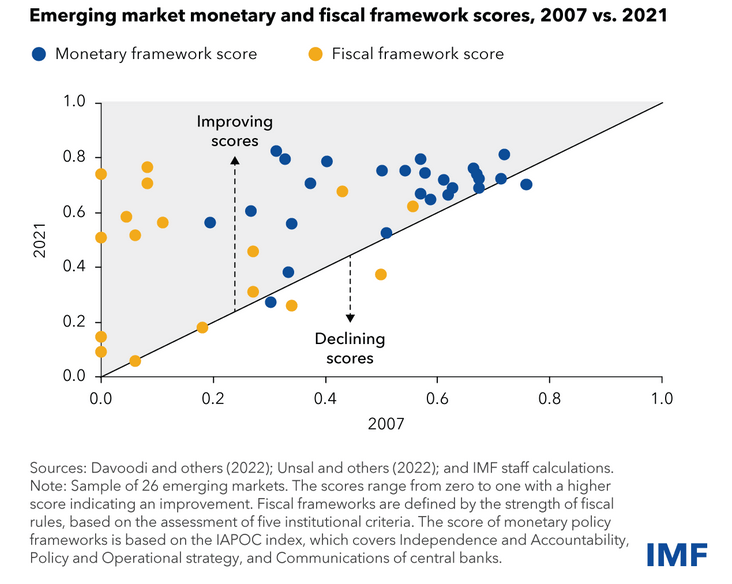

Third priority is to sustain the monetary, fiscal, and financial policy frameworks that were implemented, especially in emerging market economies.

Source: IMF

Lastly, emerging markets and developing economies must exert significant efforts to increase their green investment growth while reducing fossil fuels dependence noting that cutting emissions is compatible with growth. However, this transition requires considerable public and private investments as well as transfer of technology from China and other advanced economies.

Source: IMF

Disclaimer :

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only.