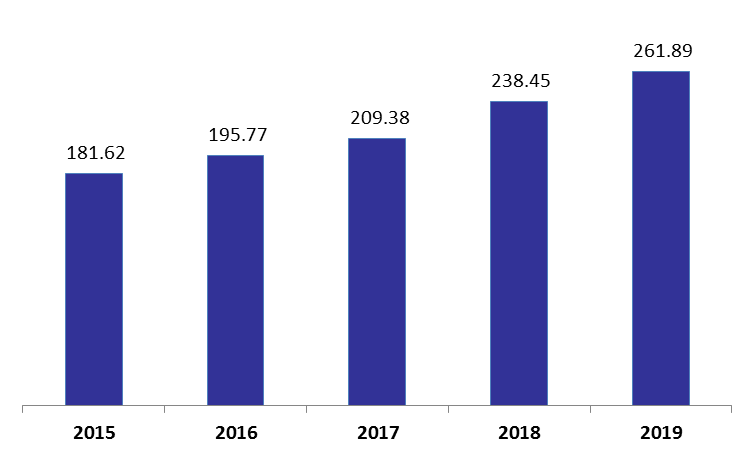

According to Lebanon’s consolidated commercial banks’ balance sheet, total assets grew by 4.97% year-to-date (y-t-d), to stand at $261.89B by August 2019.

In details, Resident customers’ deposits (which grasp 51.18% of total liabilities) decreased by 1.04% y-t-d to $134B by August 2019, with deposits in LBP declining by 5.60% y-t-d to $43.87B while deposits in foreign currencies recorded an uptick of 1.34% y-t-d to 90.17B. As for the Non-resident customers’ deposits (14.14% of total liabilities), they decreased by 1.86% y-t-d and totaled $37.02B over the same period on the back of a drop in deposits in LBP and in foreign currencies by 9.58% and 0.87% to $3.89B and $33.12B, respectively. As such, the dollarization ratio for private sector deposits slightly increased from 70.60% in December 2018 to 72.01% in August 2019. Accordingly, total resident and non-resident customers’ deposits stood at $171.06B by August 2019, declining by 1.42% y-t-d. In their turn, resident financial sector liabilities grew by 3.86% y-t-d to $1.47B.

On the assets side, Reserves (constituting 57.99% of total assets) recorded a 16.13% y-t-d increase to settle at $151.87B by August 2019. The increase in reserves came on the back of a 16.12% y-t-d climb in deposits with the central bank (BDL). Meanwhile, Claims on resident customers (18.39% of total assets) retreated by 7.02% y-t-d, to stand at $48.16B by August 2019. As for Claims on the government, they declined by 5.64% since the beginning of the year to stand at $33.20B. In details, the subscription to T-bills in LBP and to Eurobonds recorded a decline by 3.89% and 7.02% to $16.70B and $14.91B, respectively by August 2019.

Total Assets of Commercial Banks by August (in $B)

Source: BDL