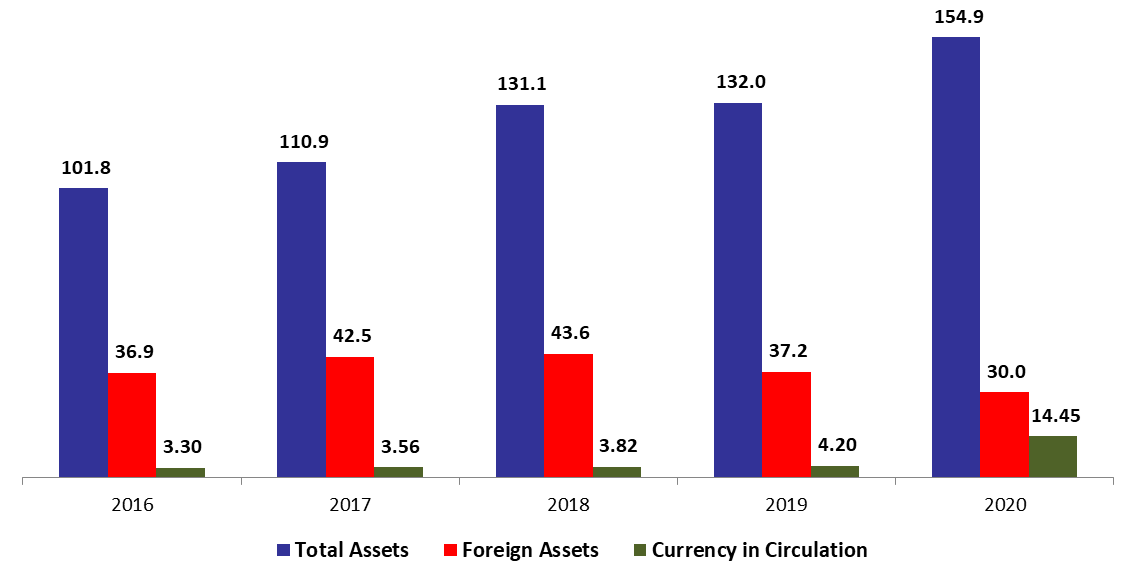

According to the balance sheet of Banque du Liban (BDL), the central bank’s Total assets added 9.59% since year-start, to reach $154.90B in mid-August 2020. The increase was mainly due to the 28.13% rise in gold prices since the start of the year to $1,943.75/ounce by mid- August 2020. As a result the “Gold” account (composing 11.60% of BDL’s total assets) increased by 28.89% to $17.96B.

BDL’s foreign assets (grasping 19.35% of total assets) decreased by 19.58% ($7.30B) year to date (YTD) to stand at $29.97B in mid-August 2020. In details, starting May 27th, BDL began extending to commercial banks foreign currency to support imports of raw materials for industrial exporters including the agro-food industry, and of basic food imports including a basket of 300 essential food items. Worth mentioning that during the first 2 weeks of August alone, the foreign assets dropped by $709M. In turn, BDL’s Securities portfolio (25.17%of total assets) climbed to $38.99B, up by 2.64% year-to-date (YTD) in mid-August 2020.

On the liabilities front, Financial sector deposits (70.87% of BDL’s total liabilities) recorded a downtick of 1.99% YTD to settle at $109.70B in mid-August 2020. Notably, Currency in Circulation outside of BDL (9.33% of BDL’s total liabilities) rose from $7B end-December 2019 to $14.45B in mid-August 2020. This uptrend in circulated currency has been ongoing since the beginning of the year, as it continues to reflect clients’ strong preference for cash amid the growing uncertainty and feeble trust in the economy. In addition, BDL’s circulars No.148 and 151 further supported and facilitated cash withdrawals, as the circulars allowed depositors with foreign currency accounts to withdraw their savings in Lebanese lira at close to the market rate.

Worth mentioning that on August 6th 2020 BDL issued circular 152 in which it provides financial support to those affected by the horrible explosion that hit the Port of Beirut on August 4th 2020. With the proper supporting documentations, the support involves extending through Lebanese banks exceptional loans – irrespective of loan limits — in USD to individuals, small-and medium- size enterprises, and corporates so as to repair their houses and offices. The loans are at 0% interest rates and commissions and are extended over five years.

BDL Currency in Circulation, Total and Foreign Assets in Mid-August (in $B)

Source: BDL, Blominvest Bank