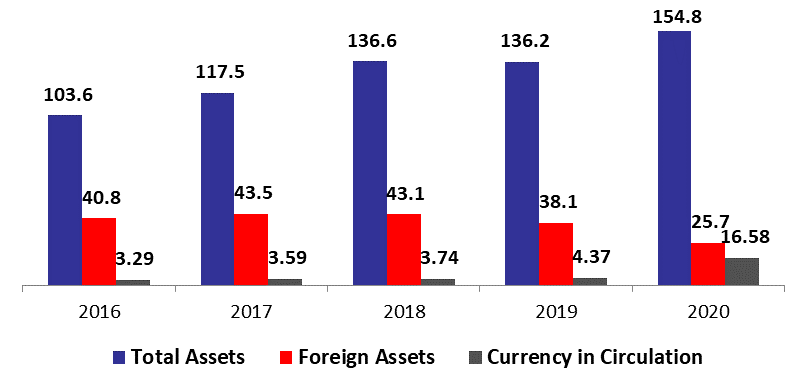

According to the balance sheet of Banque du Liban (BDL), the central bank’s Total assets added 9.49% since year-start, to reach $154.77B in Mid-October 2020. The increase was mainly due to the 25.76% rise in gold prices since the start of the year to $1,907.82/ounce by Mid-October 2020. Moreover, the Gold reserves at BDL (composing 11.28% of BDL’s total assets) increased by 25.20% to $17.45B in the first half of October as gold prices improved following the increase in safe haven demand due to the resurgence of the COVID-19 pandemic. Meanwhile “other assets” was increased by 80.16% since year-start to reach $44.97B in mid-October 2020. The huge swell in “other asset” is explained by seigniorage profit. This unorthodox accounting has raised concerns about transparency.

As the BDL continues to subsidize the import of basic commodities, the BDL’s foreign assets (grasping 16.60% of total assets) decreased by 31.06% years to date to stand at $25.70B in mid-October 2020. It is worth mentioning that foreign currency reserve at BDL has dropped approximately to $19.30B which rings the bell to find other solution in order to finance the importation of basic commodities. In details, Central Bank Gov. Riad Salameh informed the government in his last meeting, that BDL has around $2.3 billion left to subsidize basic goods, and will rationally spend it to last longer than three months. Further BDL and the Finance ministry are working on plan to reduce the subsidies instead of lifting them in one shot. In turn, BDL’s Securities portfolio (25.67% of total assets) climbed to $39.84B in mid-October 2020, up by 4.87% since the start of the year.

On the liabilities front, financial sector deposits (69.64% of BDL’s total liabilities) recorded a downtick of 3.78% YTD to settle at $107.79B in Mid-October 2020. This contraction is explained by big withdrawals that are executed from depositors. This also relates to currency in circulation outside of BDL (10.71% of BDL’s total liabilities) which rose from $7B end of December 2019 to $16.58B in Mid-October 2020. This uptrend in circulated currency has been ongoing since the beginning of the year, as it continues to reflect clients’ strong preference for cash amid the growing uncertainty and feeble trust in the economy. In addition to BDL’s circulars No.148 and 151, which further supported and facilitated cash withdrawals, Circular 572 dated 9 October 2020 explains that clients holding US Dollar deposit accounts and are intending to debit their account, would be able to settle the transaction at the equivalent rate in LBP available on the Electronic Platform, currently at LBP 3,900 per US Dollar, and in conformity with the BDL limits, to an extended period ending on 31/3/2021.

BDL Currency in Circulation, Total and Foreign Assets in Mid-October (in $B)

Source: BDL, Blominvest Bank