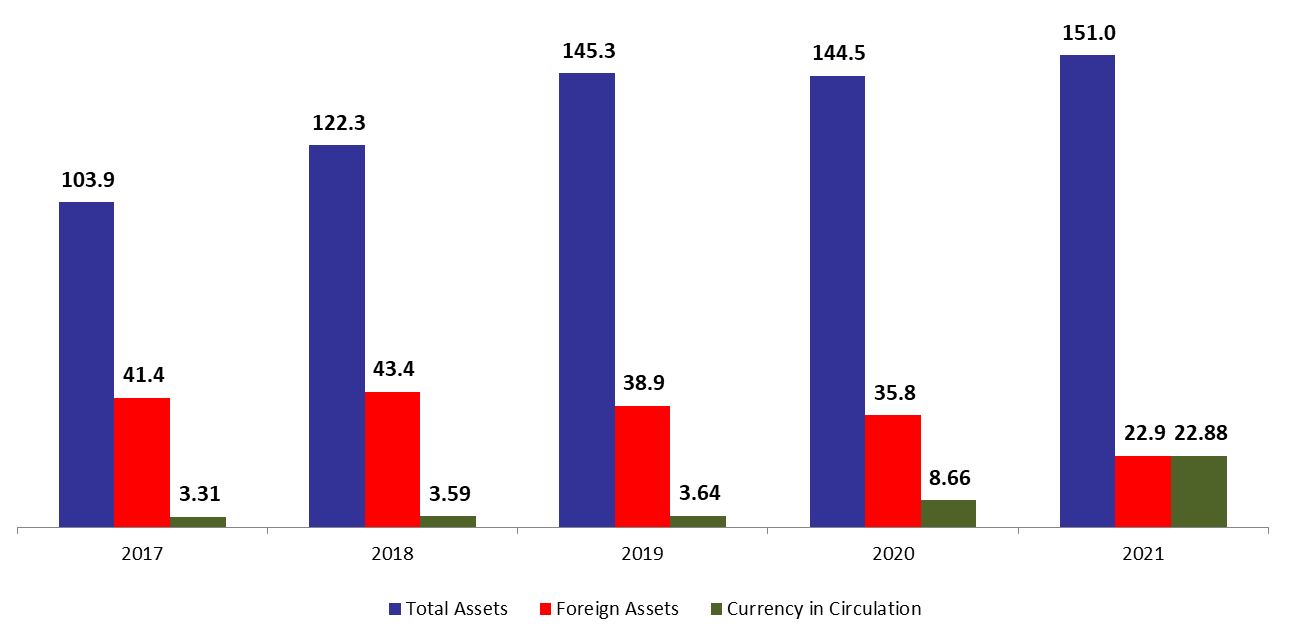

According to the balance sheet of Banque du Liban (BDL), the central bank’s total assets added 4.52% compared to last year, to reach $151.01B by end of February 2021. The increase was mainly due to the 8.58% rise in gold price compared to last year to reach $1,733.49/ounce end of February 2021. As a result, the “gold” account (composing 10.76% of BDL’s total assets) increased by 8.29% to $16.25B. In addition, “Other assets”, grasping 29.67% of BDL’s total assets, rose by 58.05% year-on-year (YOY), to reach $44.81B. In fact, this account was boosted using unorthodox accounting measures whereby BDL took a different approach by recording expected profits from seigniorage as an asset. Moreover, this act raised questions about BDL’s transparency during the country’s financial system crisis.

BDL’s foreign assets (grasping 15.16% of total assets) decreased by 36.04% YOY to stand at $22.89B end of February 2021. In details, this account mainly includes Eurobonds held by BDL, and reserves that BDL possesses with foreign correspondents. In fact, this account doesn’t totally reflect the real situation. For instance, Eurobonds are estimated to be $5B, however those Eurobonds are currently trading on average at 15 percent per dollar, which raises questions about the real value of Eurobonds on BDL’s balance sheet.

On the liabilities front, financial sector deposits (71.68% of BDL’s total liabilities) recorded a downtick of 3.90% YOY to settle at $108.24B end of February 2021, of which more than two thirds are denominated in dollars.

Looking at Currency in Circulation outside of BDL (15.15% of BDL’s total liabilities) it increased from $8.66B end of February 2020 to $22.88B end of February 2021. In fact, depositors preference for cash is growing amid the uncertainty and lack of trust in the economy. In addition, BDL’s circular 151 facilitated cash withdrawals at the rate of 3,900 LBP per USD, which in turn supported the uptrend in the currency circulated and may have dramatic impact on the value of the Lebanese pound.

For decades, the central bank of Lebanon has been known by steadying the country’s finances during the violent conflicts that devastated Lebanon and the surrounding region and in spite of successive Lebanese government failure to enact the necessary reforms. But now he faces criticism for the country’s worst socio-economic crisis.

BDL Total, foreign assets and currency in circulation as the end of February ($B)

Source: BDL, BLOMINVEST