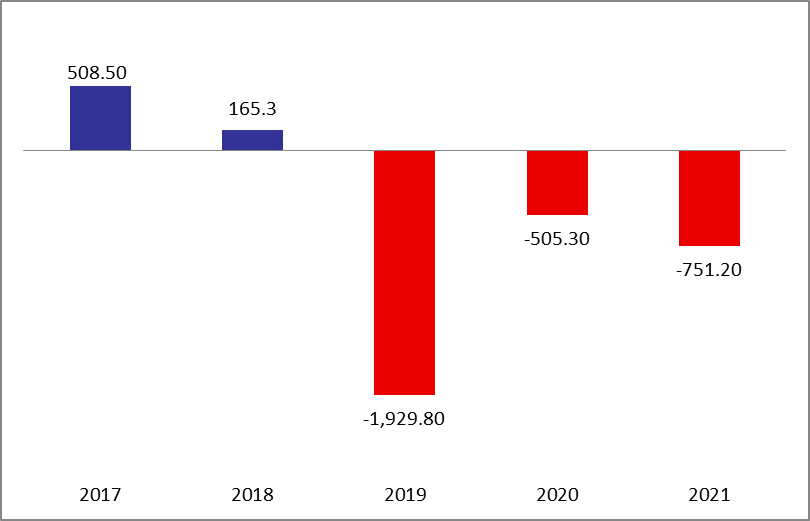

According to BDL’s latest monetary report, the BOP recorded a cumulative deficit of $751.2M by February 2021, compared to a deficit of $505.3M over the same period last year. Accordingly, Net foreign Assets (NFAs) of BDL fell by $1,088.1M. While the NFAs of commercial banks added $336.9M for February 2021.

On a monthly basis, the BOP deficit stood at $340.6M, as NFAs of BDL fell by $457.3M, and that of Commercial banks rose by $116.7M.

For a meaningful analysis, we examine the NFAs of commercial banks. For the month of February; the decline in foreign liabilities can be largely attributed to the reduction in the “Non-resident customer deposits” by $116.63M; while the foreign asset also decreased owing it to the decline of $169.57M in the “Claims on non-resident customers” but increased by $102.19M due to the rise in claims on non-resident financial sector.

On the whole, the decline in BDL’s NFAs on a monthly basis is likely attributed to the continued support of essential goods including medicines and fuel. Important to note that Lebanon’s Ministry of Finance said that BDL has less than $1B to continue subsidizing essential goods before reaching required reserves.

Balance of Payments (BoP) by February (in $M)

Source: BDL, BLOMINVEST