Concerned for the tech industry, and encouraged by the high education level and entrepreneurial spirit, the Central Bank in Lebanon issued the Circular 331 on August 22nd 2013, with the purpose to improve the Lebanese eco-system along with stimulation for investments in start-ups companies, and raising hope for entrepreneurs.

In more details, the circular 331 made the way for entrepreneurs to receive financial support directly from commercial banks or through special venture capital funds. As such, it stipulates that those kinds of investments made by a bank will get a funding and a loss guarantee up to 75% of the investments. At the same time, profits are split between the participating banks and the central bank by 50-50%.

Further, adjustments have been added to the circular in order to ensure that the Funds comply with the main objective of the Governor’s intention. For instance, the amount of investments made by any single bank should not exceed 3% of its shareholders’ equity but later on it has been modified to 4%. Also, the bank cannot invest more than 10% of the aforesaid 4% in a single company. In addition, the participation of banks through the provisions of this circular can’t also surpass, at any time, 80% of the capital of a single company.

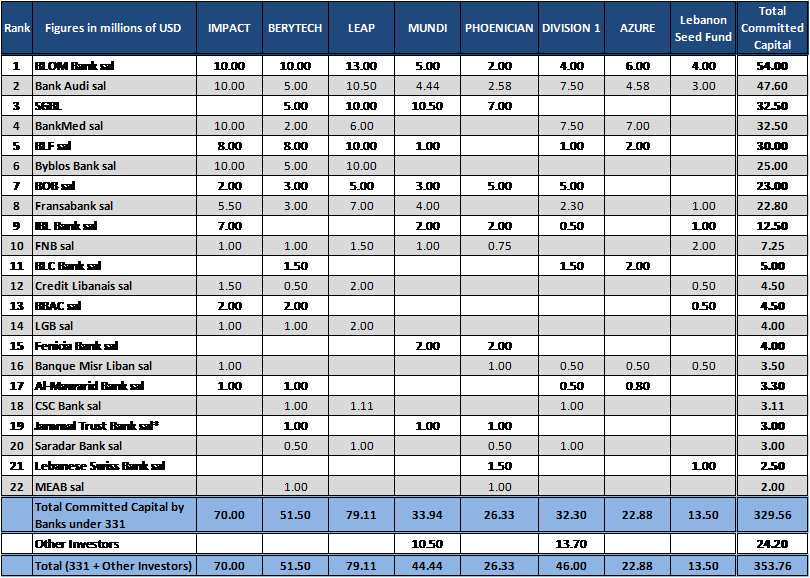

Moreover, total capital committed by Lebanese banks to the 8 existing Funds reached $329.56M by end of December 2020, out of which $281.38M where used by startups companies till that period. In addition, Lebanon’s tech sector had received 162 investments between 2013 and 2017, according to ArabNet.

On the whole, the circular issued to retain top human assets while promoting the country’s ecosystem, and making steps to a knowledge-based and tech-oriented economy. Not to mention that BDL’s circular aimed to attract foreign companies to invest in Lebanon. In addition, it has generated over $1B to the Lebanese GDP and created over than 3000 new jobs, founded more than 180 start-ups, and in parallel aligned firms like venture funds, and co-working space communities.

In short, the startup sector in Lebanon accounts today for nearly $1B which is far from where it was just before the launching of the circular. This progress has come with the support of the central bank. However, no matter how much BDL helps this sector, it cannot compensate for the inattentive and absence of the State and a beneficial economy environment, both in terms of infrastructure and regulation, not to mention political stability. Meanwhile, last year has been challenging in abnormal ways for any company across the country. As a result, though the BDL’s initiative was the first of its kind; it has not been able to put Lebanon on the track of a startup economy.

Breakdown of Committed Capital as of December 31st, 2020

Source: BLOMINVEST