Lebanon struggles today amid galloping high inflation, characterized by an uncontrolled rise in prices. Undoubtedly, the main cause of this hyperinflation can be attributed to the increased supply of cash money in circulation injected by the Central Bank. However, the printing of Lebanese pound is considered essential for the continuation of State financing. Otherwise, the State will dive into bankruptcy and will become unable to pay salaries and other basic expenses. In this aspect, the crucial question that pops up is; “how much cash can BDL issue and has it exceeded its legal ceiling?”

According to the Lebanese Code of Money and Credit, “the Central Bank should retain, among its assets, bullion of gold and foreign currencies that provide a coverage for the Lebanese pound, equivalent in value to at least 30% of the value of the cash it issued and the value of its demand deposits in LBP, provided that the values of gold and the foreign currencies are not less than 50% of the value of the issued cash”.

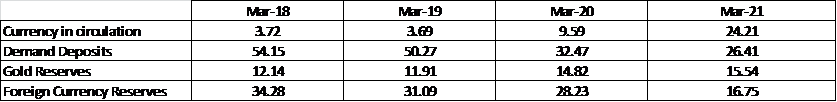

In details, the value of the issued cash in Lebanon, shown as the currency in circulation outside BDL, jumped by 399.67% since October 2019, from LBP 7,305.42B to LBP 36,502.79B at end of March 2021. The largest monthly increase figured between October and November 2019 with 23.95% uptick in just one month.

On the other hand, demand deposits amount to LBP 39,812.51 B at end March 2021, and added to the currency in circulation at the same period will be LBP 76,315.3B. Today with the Central Bank having only LBP 25,253.76B ($16.75B) as reserves of foreign currencies and are being consumed for subsidies, the only remaining coverage for cash issued will be the gold reserves whose value reached LBP 23,431.16B ($15.54 B) by end of March 2021. By the aforementioned numbers, gold constitutes 30.7% of demand deposits and issued cash. On gold alone, it indicates that the Central Bank in Lebanon has just equaled the set ceiling of 30% and hence it cannot pursue with printing money.

However, if we take into consideration the foreign currency reserves of BDL, adding to the gold one, the percentage of coverage will increase to 64% of the deposits and cash printed, therefore the Central Bank in this case can continue issuing cash from a legal stand point, though from an economic viability stand point it is a different matter. As important, the percentage rises to 133% of the cash printed.

Assuredly, the Central Bank appears to have identified the risk of this act, so it has adopted measures aimed to reducing cash in circulation in the market. Such as, requiring importers of subsidized products provide cash in Lebanese pound to obtain dollars, also by setting limits on Lebanese pound withdrawals. However, in order to have a sustainable adjustment of the situation, the first step to reinstate confidence remains with the formation of a competent new government capable of setting a plan of reforms and restoring stability to the country, not to mention ways to reinforcing BDL’s foreign currency reserves.

Issued Cash, Demand Deposits, Gold Reserves, and Foreign Currency Reserves of BDL, ($ B):

Source: BDL, BLOMINVEST