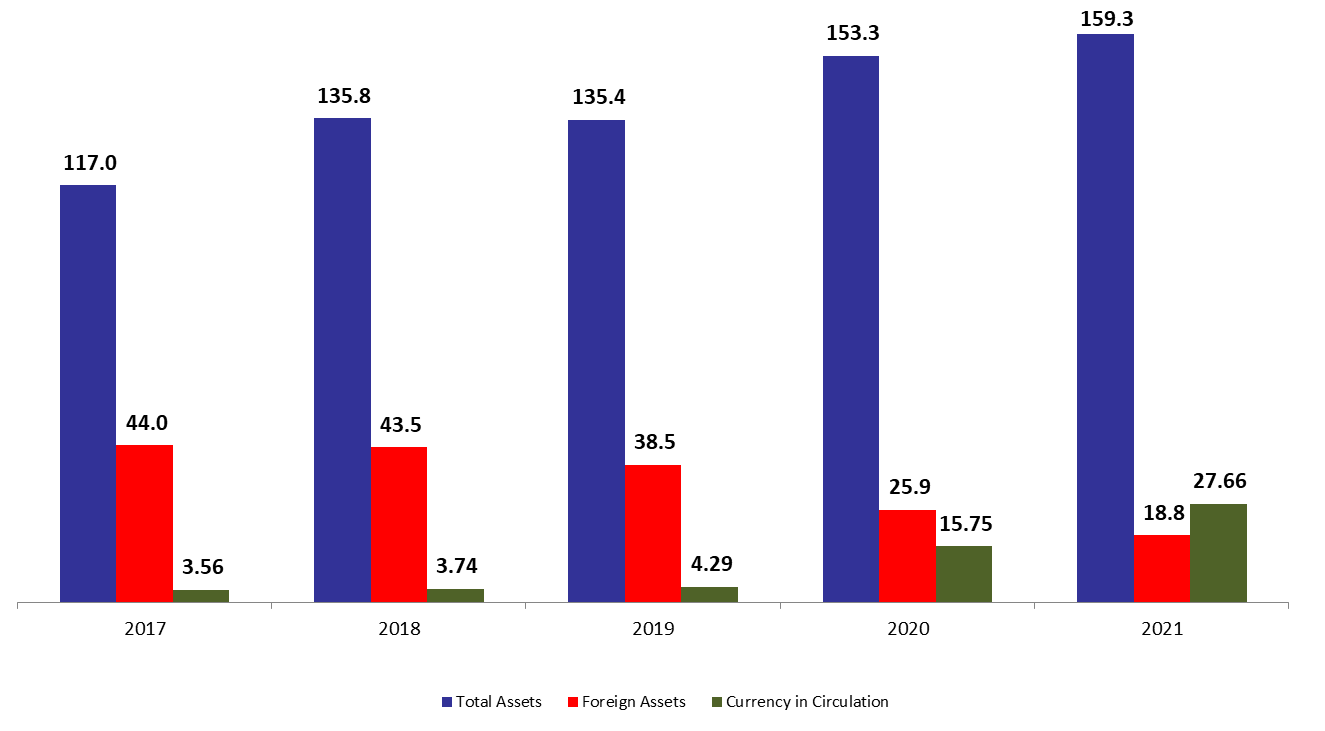

According to the balance sheet of Banque du Liban (BDL), the central bank’s total assets added 3.93% compared to last year, to reach $159.34B by end of September 2021.The increase was mainly due to the 31.47% year-on-year (YOY) rise in other assets, grasping 36.14% of BDL’s total assets and reaching $57.59B by end of September 2021. However, the gold account, composing 10.02% of BDL’s total assets, decreased by 8.06% yearly to reach $15.96B by the same period.

BDL’s foreign assets (grasping 11.79% of total assets) decreased by 27.52% YOY to stand at $18.79B by end of September 2021. Important to note that BDL’s foreign assets added 4.82% since last published BDL’s balance sheet on mid-September 2021 as a result of the reception of funds from IMF which are strongly needed as Lebanon struggles with one of the deepest crisis in modern history.

On the liabilities front, financial sector deposits (66.80% of BDL’s total liabilities) recorded a downtick of 1.08% YOY to settle at $106.44B by end of September 2021. Concerning the other liabilities, it was subject to a remarkable increase of 44.83% (totaling $1.26B) from September 15, 2021 mainly due to adjustment operations aligned with the new allocation of IMF amounting $1.135B. However, the increase in foreign assets was only $863.34M for the same period which raises questions about a difference of $271.65M that might have been used for subsidies, or that a second tranche of IMF funds close to $280M is yet to come.

Looking at Currency in Circulation outside of BDL (17.36% of BDL’s total liabilities) it increased by 75.64% jumping from $15.75B by end of September 2020 to $27.66B end of September 2021.

BDL Total, Foreign assets and Currency in Circulation end of September ($B)

Source: BDL, BLOMINVEST