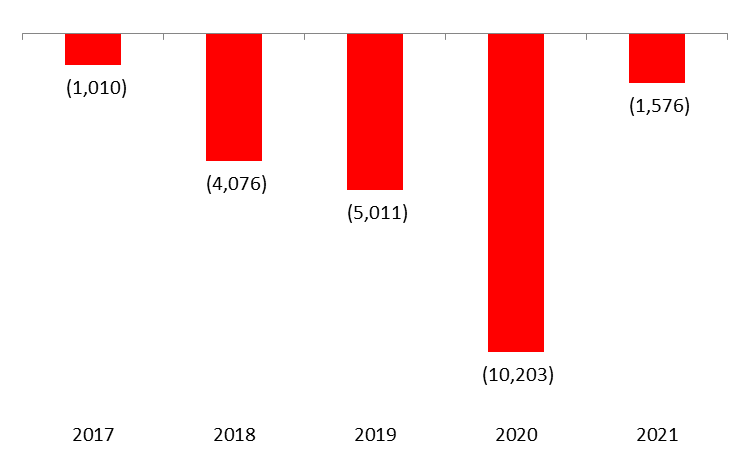

According to BDL’s latest monetary report, the BOP recorded a cumulative deficit of $1,576 M by November 2021, compared to a deficit of $10,203M over the same period last year. Accordingly, Net foreign Assets (NFAs) of BDL fell by $4,181.2M, while the NFAs of commercial banks added $2,605.1M by November 2021.

On a monthly basis, the balance of payment recorded a surplus of $159.9M in November 2021.

For a meaningful analysis, we examine the NFAs of commercial banks. For the month of November, the reduction in foreign liabilities is much larger than the decrease in foreign assets. On the liabilities side, “Non-resident financial sector liabilities” and “Non-resident customers’ deposits” witnessed a reduction by $83.89M, and $1.02B to reach $4.994B and $22.73B, respectively by November 2021. On the asset side, “Claim on non-resident customers” has decreased by $555.37M to reach $24.82B by November 2021. In addition, the NFA of BDL declined by $339M due to the funding for essential goods and services.

On a related note, BDL issued Circular 158 in mind 2021 which provides binding instructions to banks to pay back gradually their customers’ foreign currency deposits. The circular applies to all accounts opened before 31/10/2019 and calculated based on the accounts as of 31/3/2021, and involves payments of 400$ per month per account. This circular will likely decrease gradually the foreign assets of the commercial banks. In addition, BDL issued circular 161 in late 2021 which allow banks to sell dollars provided by BDL at the “Sayrafa” exchange rate. This circular in turn, will likely decrease the foreign asset of BDL.

Balance of Payments (BoP) by November (in $M)