The IMF and the Lebanese authorities have reached a staff level agreement (SLA) that could be supported by a 46-month extended Fund Arrangement (EFF) with access to $3 Billion. The agreed program is subject to IMF management and the Executive Board approval after implementing all prior actions. It aims to rebuild the economy, restore financial sustainability, strengthen governance and anti-corruption frameworks and establish a credible and transparent monetary and exchange rate system. In this note, we will briefly discuss this article, and state our opinion (see IIF “Lebanon’s IMF agreement- A call to action with challenging hurdles” April 11, 2022).

The economic crisis in Lebanon is fueled by years ‘of inconsistent macroeconomic policies, high corruption, dysfunctional sectarian and judicial system, and failed attempts to address policy distortions in the economy. In addition, the wide external current account deficit was largely the product of an overvalued currency, which encouraged higher imports and private consumption. The banks were supported by artificially high returns on their deposits at BDL and on government Treasury Bonds. Consequently, the high interest rates weighed more and more on the budget, which was financed by increased borrowing. This process generated a vicious circle of rising public debt and widening fiscal deficits.

The current Lebanon- IMF staff level agreement aims to restructure the financial sector as follows: (1) restructure the banking sector and address the large financial losses (2) take on the parliamentary approval for emergency bank resolution legislation (3) evaluate externally the 14 largest banks (4) reform the banking secrecy law to bring it in line with international standards and (5) audit the central bank’s foreign assets. In addition, the IMF requests to go through the parliamentary approved 2022 budget, restructure the medium term debt and finally unify the multiple exchange rates that have existed since mid-2019.

The restructuring of the financial system (five out of eight of the prior actions) will be the most difficult part of a potential IMF program. While, we witness the Lebanese banking sector cutting cost by merging branches and shrinking their balance sheet, they should be audited to determine which banks are solvent and which are not. In fact, assets and liabilities of bad banks should be consolidated, small depositors fully paid, and all remaining assets auctioned off to protect larger depositors. All of these operations should be implemented in the hope of creating a smaller, leaner and healthier banking sector.

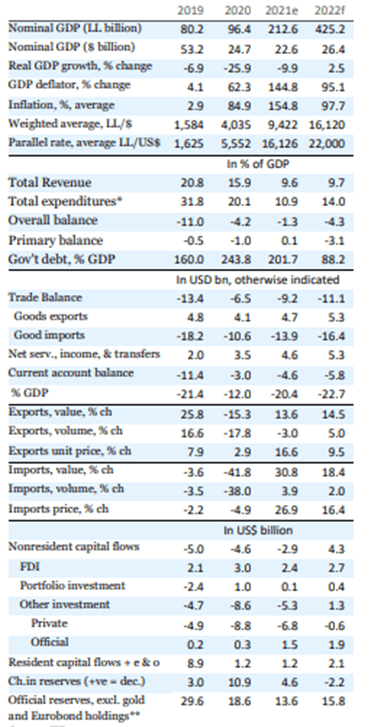

On another note, Lebanon urgently needs to reform the electricity sector (Edl), telecom, the water sector, the ports systems, and state owned entities, with consideration to privatize and regulate such utilities. Consequently, with the help of IMF and while implementing better fiscal measures, we expect that the public debt follows a decreasing trend. Also, we expect to achieve macroeconomic stability in the short run with a relatively stable unified market-determined exchange rate. As a result, real GDP could possibly grow by 2.5% in 2022 and by 8% in 2023, and inflationary pressures would ease following an appreciation of the unified exchange rate.

The SLA is a first step in the right direction covering a wide range of potential reforms. We hope that the Lebanese authorities seize this opportunity and start soon implementing the urgent reforms in order to put an end to the further deterioration of the economy, thus reducing the risk of total collapse. Structural changes to the political system, including new and non-corrupt representatives in the parliament would make passage of comprehensive economic reforms easier.

In our opinion, the implementation of the above IMF reforms is a long and painful process, if it’s ever achieved; but we hope that all reforms be implemented and pave the way to a steady and strong economy in Lebanon. While coming to an agreement with the IMF, we expect new investments to generate additional cash flow; also, the unified exchange rate will relieve the Lebanese population from the high inflation that was witnessed in the last two years. However, we are still hesitant regarding the elimination of the corruption in Lebanon, as we expect the same political class to be re-elected in the parliamentary elections of May 2022.

Source: IIF “Lebanon’s IMF agreement- A call to action with challenging hurdles” April 11, 2022

By: Stephanie Aoun