The Lebanese currency has been hovering around a steady level for the last two month marked by continuous intervention by BDL through Sayrafa. However, just two days after the elections concluded and under a drastic fall of the Lebanese currency against the dollar rate, the Central Bank has once again extended the mechanism of the Circular no 161 for two more months.

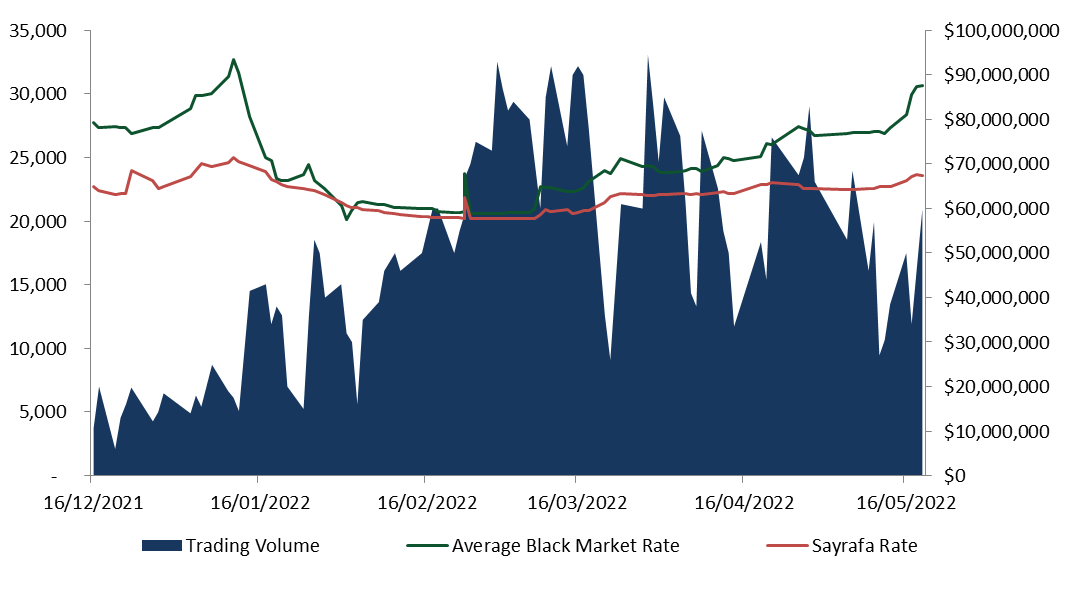

The Lebanese exchange rate has increased remarkably and recorded 28.78% jump since first of April and 52.77% since first of February to a drastic level of LBP/USD 30,700 by 19, May, 2022. On a different note, the Sayrafa platform rate, which stood steadily lower than the parallel exchange market rate all over the last period, was standing around LBP/USD 23,600 by 19, May 2022.

Despite Governor’ Promises to keep on injecting dollars through Sayrafa platform, the volumes of dollars offered by banks to their customers have been falling for the last week. Changes in volume were remarkably noticeable and higher for the month of April. For instance, average daily volume of transactions was higher than $56.52M per day for the first 20 days of April, whereas the average daily volume was only $46.50M for the first 20 days of May. In turn, total traded volume for the first 20 days of April and May totaled $678.30M and $511.50M, respectively.

On a different level, BDL’ foreign assets dropped by 9.91% or exactly $1.76B since end of December 2021 to $16.06B by mid-May 2022 while total volume of dollars injected into the system through Sayrafa amounted to $4.49B for the same period, the difference might be explained by BDL’s measures to absorb dollars from the market, especially in a climate of diminished LBP liquidity. However, injecting dollars through sayrafa is like pegging the Lebanese currency, both require ongoing interventions of Central Bank that lead to the diminishing of the foreign currency reserves. Moving forward, the national currency would be backed by fewer foreign currency which would likely result in further devaluation of the Lebanese currency and losses of BDL would also continue to grow due to inaction on the reform level.

Several reasons could justify the huge jump in the exchange rate of the Lebanese currency as such: Lebanese behavior towards the market coupled with uncertainty as political deadlock and fragmented parliament would place the economic reforms on the back seat. Higher global commodity prices due to the ongoing war especially fuel would further weighed on the demand for the foreign currency in Lebanon most importantly to cover a more expensive import bill. Henceforward, the current account deficit would eventually increase again. And to venture into the near future, look for more LBP parallel market depreciation and less Sayrafa volumes!

Trading volume on Sayrafa, average parallel market rate and Sayrafa rate for the period between 16/12/2021 and 19/05/2022:

Source: BDL, BLOMINVEST BANK SAL