The latest statistics on activity at the Port of Beirut show an annual decrease of 15.03% in the revenues of the Port of Beirut (PoB) to $6.40M by October 2021, compared to last year’s $7.54M. We note that no later data on revenue are available as per Port of Beirut statistics.

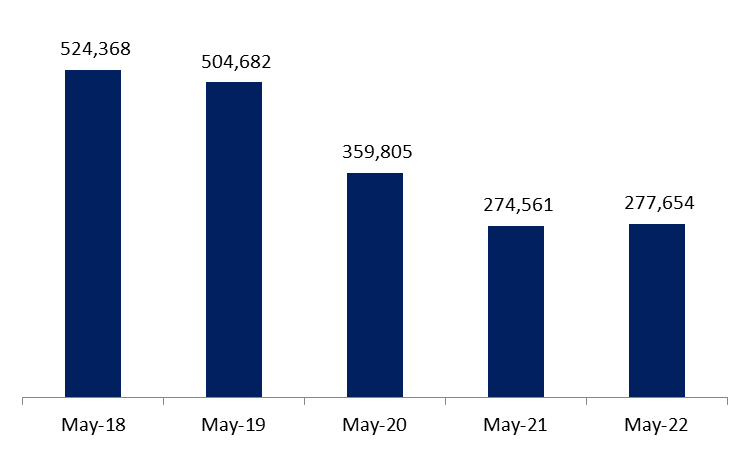

By May 2022, total container activity including transshipment (TEU+TS) increased by a yearly 1.13% to stand at 277,654 twenty-foot equivalent unit (TEU); container activity (TEU) added 6.26% on a yearly basis to 223,651 TEU by May 2022, while transshipment activity (TS) alone dropped by 15.03% YOY to 54,003 TEU by the same period.

In more details, and on a monthly basis, the transshipment volume of CMA CGM, one of the two major shipping lines operating at the Port of Beirut slightly decreased by 34.95% YOY to stand at 7,796 TEU in May 2022. In the same token, transshipment volume of MSC, the other major line, also declined by 0.64% YOY to 1,086 TEU in May 2022. Furthermore, the local volume of CMA CGM jumped substantially by 18.49% to reach 17,180 TEU same for the local volume of MSC which increased by 5.75% to stand at 8,913 TEU for the month of May 2022.

The Middle East has been considered an ideal transshipment hub for ports activities on the Europe-Asia line. However, economic and political turmoil in Lebanon as well as delayed implementation of the needed reforms weighed on the Port of Beirut activity and left a room for other ports in the region to increase their activities. In addition, recent normalization agreement with the UAE-Israel, and the new contribution of the UAE in the exclusive $6B investment package to build red sea port in Sudan, were front and center in 2022 adding a key risk to Port of Beirut activity’s growth. Not to mention, the World Bank and S&P Global Market Intelligence container port performance index indicated that ports in the Middle East took four of the top five spots in the global ranking. Saudi Arabia’s King Abdullah Port tops the ranking for the year of 2021, with regional competitors Port Salalah in Oman, Hamad Port in Qatar and lastly Port Khalifa in Abu Dhabi. Port of Beirut sadly is nowhere to be seen.

Yearly total container activity including transshipment (TEU+TS) in twenty-foot by May

Source: PoB, BLOMINVEST