Lebanese banking sector played a key role on the national and regional levels and outperformed even during period of economic slowdown and stagnation. However, the current crisis pushed banks into adopting retrenchment strategies, and occasionally, total exit from the foreign markets.

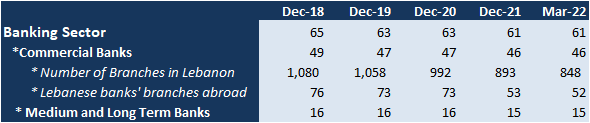

As such, total number of banks operating in Lebanon dropped from 65 in 2018 to only 61 in March 2022. Number of commercial banks in Lebanon alone plummeted from 49 banks by end of 2018 to 46 by March 2022. Similarly, banks branch network decreased by 232 branches to reach 848 branches in Lebanon by end of March 2022 with 210 branches closed down after the October revolution. In the same token, the medium and long term banks fell from 16 banks in 2018 to 15 banks till the end of March 2022.

On the international market, foreign subsidiaries and Lebanese banks’ branches abroad followed the same trend of the national market as its numbers shrunk from 76 by the end of 2018 to only 52 branches by the end of March 2022. Different groups of the Lebanese banks have liquidated their foreign assets over the past years amid constraints imposed by the regulators in the countries where they were operating, or to overcome the challenges resulting from the crisis that hit Lebanon.

In details, BLOM Bank announced in January 2021 its exit from the Egyptian market by selling its entire share to Bahrain-headquartered Arab Banking Corporation for $420 M after following Bank Audi’s similar exit strategy earlier in the same year. Moreover, Bankmed, BOB, BEMO, BBAC, BLOM Bank, Credit Libanais and IBL bank have declared that they will be closing their branches in Cyprus by the end of 2022. This action of withdrawing from the Cypriot market is a result of the tightening conditions of Cyprus Central Bank regarding deposit guarantees for Lebanese banks. In Iraq, out of 10 banks present, 3 would remain operating; BBAC, Byblos Bank, and MEAB. BLOM Bank, BLF, Audi, Credit libanais, Fransabank, and IBL Bank have been withdrawing from the market since late 2020. Furthermore by February 2022, Capital Bank acquired the ownership of SGBL in Jordan after completing a transaction of the sale of Bank Audi’s Iraqi and Jordanian assets to this bank. In the European market, Fransabank declared its decision to leave the Belarusian market while BLOM Bank changed the name of its subsidiary operating in France, Romania and London. Finally, the representative office of Credit Libanais in Montreal has been removed from the 2021 list of banks abroad.

In Conclusion, the path of the Lebanese banks is still unknown and the need for formal capital control and restructuring plan has been a demand by banks and specialists, along with implementing the needed economic and fiscal reforms. In turn, mergers and acquisition and restructuring of deposits are an inevitable solution for the banking crisis. Noting that the country would not be able to overcome its current situation without a well-functioning and resilient banking sector that would build for a new era in Lebanese banking.

Banking Sector Structure Dec 2018- March 2022:

Source: ABL, BDL, BLOMINVEST Bank