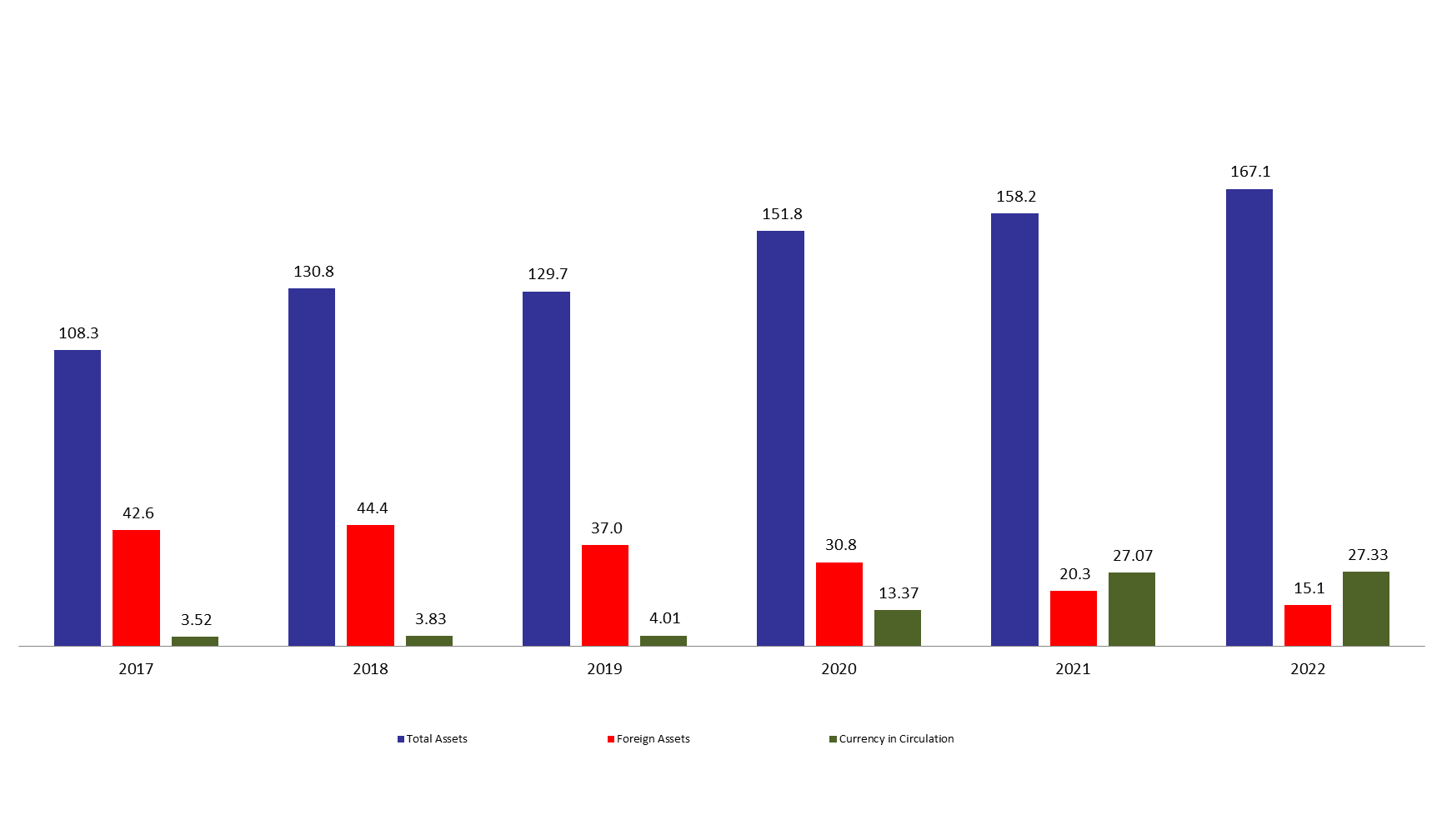

According to the balance sheet of Banque du Liban (BDL), the central bank’s total assets added 5.64% compared to last year, to reach $167.11B by mid of July 2022. The increase was mainly due to the 26.46% year-on-year (YOY) rise in other assets, grasping 41.12% of BDL’s total assets and reaching $68.71B by mid of July 2022.

Moreover, the gold account, representing 9.41% of BDL’s total assets, increased by 6.99% yearly to reach $15.71B by mid of July 2022.

Meanwhile, BDL’s foreign assets, grasping 9.04% of total assets, decreased by 25.46% YOY to stand at $15.11B by mid of July 2022, though $5B of those are in Lebanese Eurobonds. Hence, the Central Bank is surely taking measures to maintain the black market rate at approximately 29,000 LBP/USD. However, this measure is very costly as BDL is using its foreign reserve to support Sayarafa; in addition, the drop in the Euro and GBP currencies is likely having its toll on the Central Bank’ foreign assets as BDL holds foreign assets denominated in Euro and GBP. On a different note, total volume of dollars injected into the market through Sayrafa platform amounted to $7.006B YTD and $490.60M for the first 2 weeks of July 2022 while the Central Bank’ foreign assets dropped by $2.71B YTD and $224.42M for the first 2 weeks of July 2022.

On the liabilities front, financial sector deposits, 65.92% of BDL’s total liabilities, increased by 3.20% and reached $110.16B by mid of July 2022 compared to last year, of which more than two thirds are denominated in dollars.

Currency in Circulation outside of BDL, consisting of 16.36% of BDL’s total liabilities, increased annually by 0.98% only and reached $27.33B by mid of July 2022 reflecting BDL’s policy of limiting LBP liquidity from the market.

BDL Total, Foreign assets and Currency in Circulation by mid of July ($B)

Source: BDL, BLOMINVEST