In its latest World Economic Outlook of October 2022, the IMF stated that “the global economic activity continues to face steep challenges, shaped by the Russian invasion of Ukraine, a cost of living crisis caused by persistent and broadening inflation pressures, and the slowdown in China”.

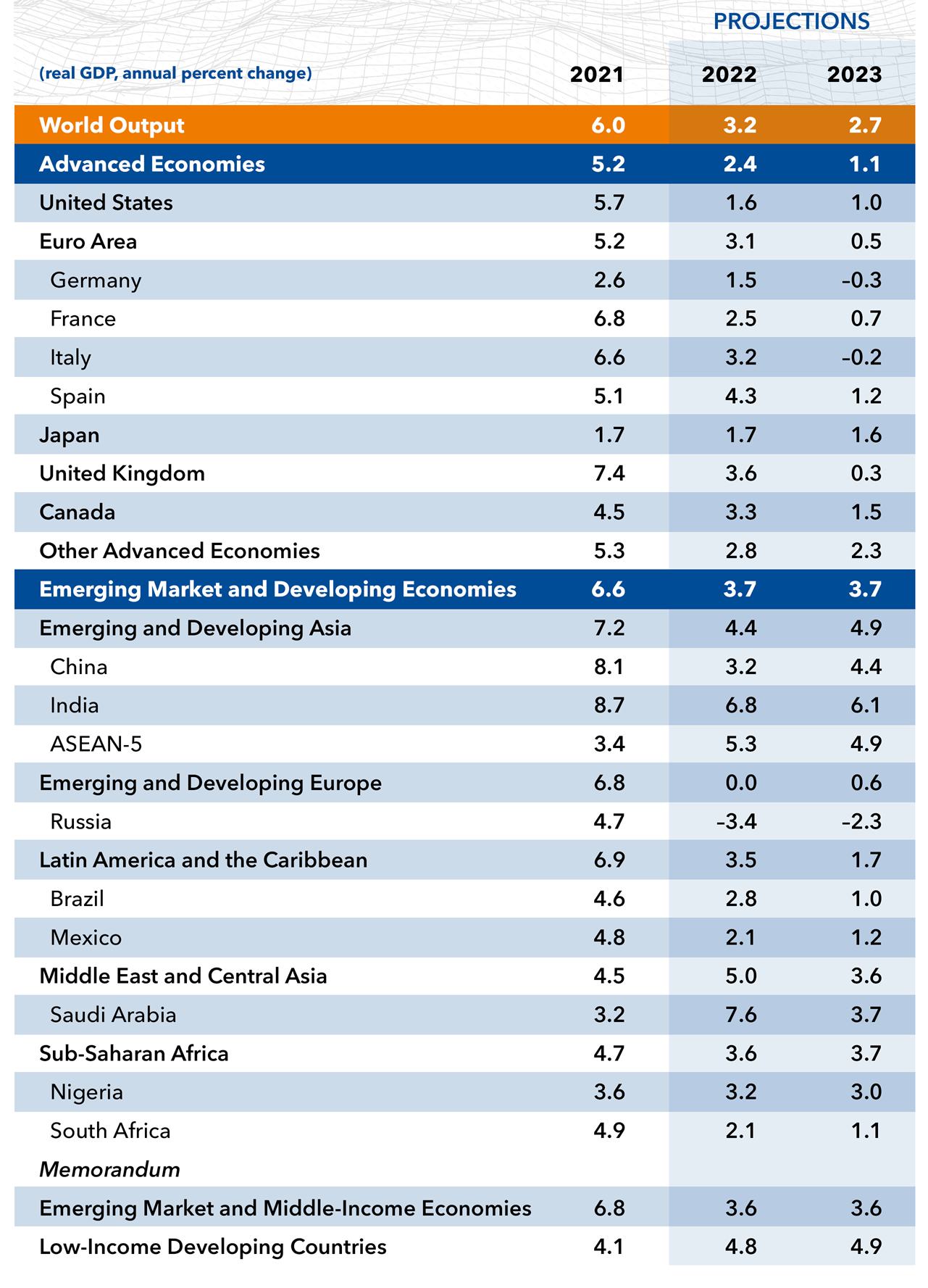

In numbers, IMF report showed that global growth forecast for the year of 2022 remained unchanged at 3.2%, while for the year of 2023. The IMF lowered its projection by 0.2 percentage points to 2.7% from July update. The revision highlighted that downside risks to the outlook remain elevated with risk of monetary, fiscal and financial policy miscalibration has risen dramatically due to high uncertainty and growing fragilities. Moreover, a strong dollar could negatively affect the financial markets by pushing investors towards safe assets.

The 2023 slowdown will be broad-based with majority of countries poised to contract this year or next. The three largest economies would continue to differ by 2023 with real GDP for the United States, China and the euro area are projected to stand at 1%, 4.4%, 0.5%, respectively. The main reasons behind this slowdown are the tightening of monetary and financial conditions for the U.S, a weakening property sector and persistent lockdowns in China, and the ongoing energy crisis in the euro zone that will continue to take a heavy toll on the euro economy. However, interesting to note the KSA and India will have among the highest growth rates in the G20 group at 7.6% and 6.8%, respectively, in 2022.

On a different note, the IMF projected broader global inflation and it is expected to rise from 4.7% in 2021 to 8.8% in 2022 but to decline to 6.5% in 2023 and 4.1% by 2024. In addition, the IMF report stated also that Inflation would go beyond food and energy as increasing global price pressures remain the most immediate threat to current and future prosperity.

Finally, a strong dollar would be a major challenge especially for many emerging markets as well as developing countries. The suitable response is to regulate and adjust monetary policy to maintain price stability and letting exchange rates adjust properly to the needed situation while preserving valuable foreign exchange reserves for stormy days.

The outlook of the worldwide economy has remarkably darkened since last July report as current rapidly rising prices and tightening financial and monetary policy would cause serious hardship for global economy. In short, policymakers need steady hand as for many countries, 2023 will more likely a recession.

Latest World Economic Outlook Growth Projections:

Source: IMF, World Economic Outlook, October 2022