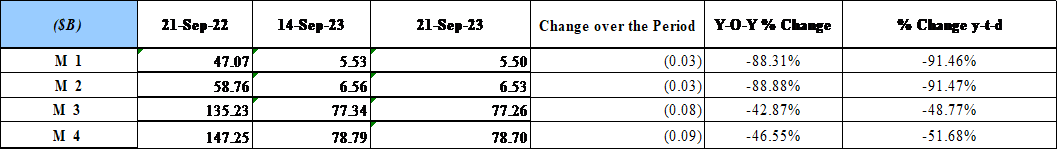

BDL’s latest statistics on money supply revealed that Broad Money (M3) dropped by LBP 1,131B to stand at LBP 1,158,908B ($ 77.26B) by the week ending September 21, 2023. Furthermore, on an annual basis, M3 dropped by 42.87% year-over-year and by 48.77% since year-start (YTD). Noting that effective February 1st 2023, the official exchange rate has been set at LBP 15,000 per dollar.

BDL’s latest statistics on money supply revealed that Broad Money (M3) dropped by LBP 1,131B to stand at LBP 1,158,908B ($ 77.26B) by the week ending September 21, 2023. Furthermore, on an annual basis, M3 dropped by 42.87% year-over-year and by 48.77% since year-start (YTD). Noting that effective February 1st 2023, the official exchange rate has been set at LBP 15,000 per dollar.

In details, M1 dropped by LBP 400B by a week to settle at LBP 82,536B ($5.50B) by September 21, due to a decrease in currency in circulation of LBP 1,364.87B and an increase in demand deposits of LBP 964.89B.

In turn, total deposits (excluding Demand deposits) dropped by LBP 730.91B ($48.72M), owing to a decrease in Terms and saving deposits by LBP 57.41B and in deposits denominated in foreign currencies by $44.90M.

As such, the rate of broad money dollarization slightly increased from 91.515% in the week ending September 14, 2023 to 91.546% in the week ending September 21, 2023.

Looking at interest rates, the average rate on deposits in LBP at commercial banks decreased from 0.74% in June 2022 to 0.67% in June 2023. Similarly, the average rate on deposits in USD at commercial banks decreased from 0.09% in June 2022 to 0.05% in June 2023. In its turn, the average lending rate in LBP and USD, at commercial banks, went down from 5.36% and 5.28% in June 2022 to 4.24% and 2.02%, respectively, in June 2023.

Analytically, the money supply M3 can be derived from combining the balance sheet of BDL with the balance sheet of banks to arrive at the monetary survey of the banking system. The resulting M3 would be equal to the sum of: net foreign assets (NFA), credit to the private sector (CPS), net credit to the public sector (NCPS), and other items net (OIN). Latest data show that in June 2023, M3 stood at LBP 1,216,472.6B versus LBP 191,721.8B in June 2022; NFA were LBP 214,717.3B compared to LBP 192,54.6B in June 2022; CPS was LBP 133,591.7B compared to LBP 35,545.6B in June 2022; NCPS was LBP 871,335.1B compared to LBP 43,671.3B in June 2023; and OIN were negative LBP 3,171.6B compared to LBP 93250.3B in June 2022, and comprising mostly (in BDL’s terminology) other assets which include open market operations and seigniorage, considered to be a controversial account by some.

Source: BDL; MoF