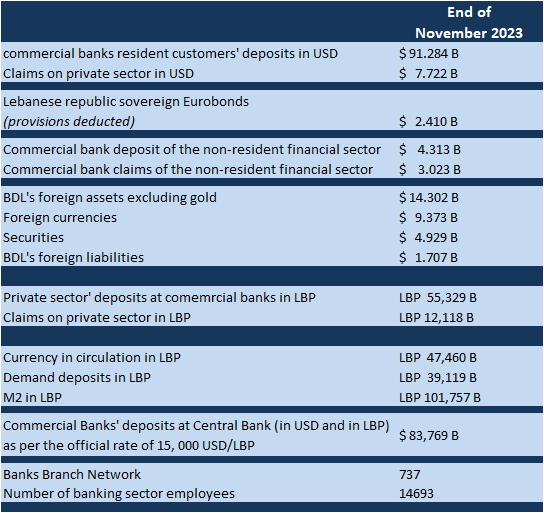

According to November ABL’s publication of banking and monetary indicators, banks branch network decreased significantly from 1,058 branches by December 2019 to reach 737 branches in Lebanon by end of July 2023, while banking sector in Lebanon experienced a contraction of about 9,167 employees, from 24,704 employees by end of 2019 to 14,693 employees by July 2023.

Furthermore, deposits with Central Bank (BDL) dropped by 28.79% from $117,642M by the start of 2020 to $83,769M by November 2023 as of the official exchange rate of 15,000 USD/LBP. In addition, foreign assets of BDL excluding gold decreased remarkably from $30.98B in October 2019 to a low of $9.373B in November 2023 while foreign securities were down by 29.18% to stand at $4.929B for the same month. Commercial banks’ claims on private sector in LBP and USD contracted respectively by 50.39% and 79.83% to stand at LBP 12,118B and USD 7.722B in November 2023. Moreover, Lebanese Republic Sovereign Eurobonds (provisions deducted) were evaluated at $2.410B in November 2023 down from $ 14.859B in September 2019.

As for the netting of commercial bank claims and deposit of the non-resident financial sector, it experienced a significant transformation, as non-resident financial sector liabilities plummeted from $9.661B to $3.023B. Simultaneously, claims on the non-resident financial sector contracted from $8.976Bto $4.31B. This suggests a significant decrease in financial risk and a restructuring of the financial environment, as the difference between claims and liabilities becomes narrower. These shifts in the balance of financial assets and liabilities are pivotal in influencing economic and sector stability.

On the liabilities side, BDL’s foreign liabilities fluctuated during the last years from $2.401B in November 2019 to $1.707B by the end of November. Nevertheless, commercial banks resident customers’ deposits in LBP and USD recorded a substantial drop from LBP 69,592 B and USD 124.138 B in September 2019 to LBP 55,329 B and $ 91,284 B, respectively, by end of November 2023.

Banking and monetary indicators November 2023:

Source: BDL, ABL