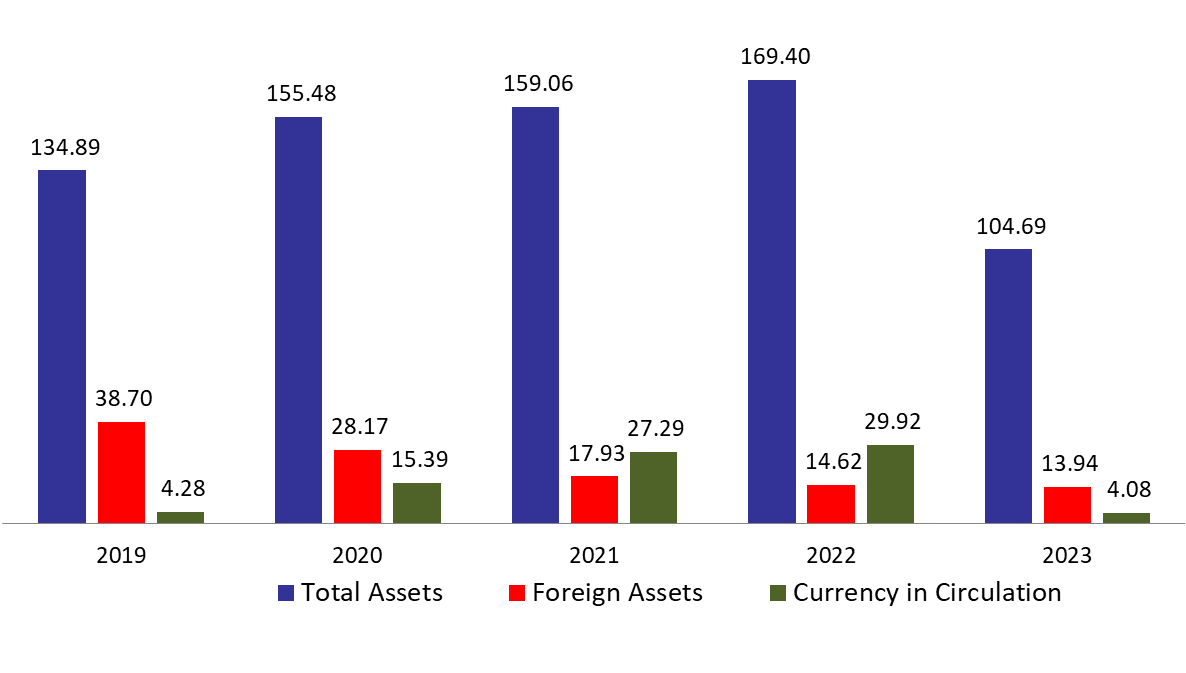

According to the balance sheet of Banque du Liban (BDL), the central bank’s total assets fell by 38.20% compared to last year, to reach $104.69B by mid of September 2023. The fall was mainly due to the 90.44% year-on-year (YOY) drop in other assets, grasping 6.63% of BDL’s total assets and reaching $6.B by mid of September 2023. Furthermore, the gold account, representing 16.90% of BDL’s total assets, increased by 13.61% yearly to reach $17.68B by mid of September 2023.

BDL’s foreign assets, consisting of 13.31% of total assets dropped by 4.68% YOY and stood at $13.93B by mid of September 2023 of which liquid foreign reserve assets totaled $8.727B ($8.573B as at 31/07/2023), noting that BDL holds in its foreign assets $5.2B in Lebanese Eurobonds. In parallel, interestingly, other liabilities plunged by 74.49% years over year to stand at $1.11B by mid of September 2023.

On the liabilities front, financial sector deposits, representing 84.81% of BDL’s total liabilities, decreased by 17.62% and reached $88.78B by mid of September 2023 compared to last year, of which more than 90% are denominated in dollars. Lastly, currency in Circulation outside of BDL, consisting of 3.90% of BDL’s total liabilities, plunged by 86.37% annually to reach $4.07B by mid of September 2023 amid adopting the 15,000 LBP/USD official rates by BDL.

Interesting to note, a statement issued on 18/9/2023 by Acting BDL Governor, Dr Wassim Mansouri, claimed that BDL liquid FX reserve assets stood at $8.498B at end August 2023, down from $8.573B declared previously in July 2023, with current accounts stood at $3.238B up from $3.114B at 31/07/2023, time accounts reached $3.490B while financial securities added 10.09% to $240M by end of August 2023. Furthermore, BDL stated that the Eurobonds at market value were $413M in August 2023, up from $387M in July 2023.

On the other flip, the statement showed that liquid FX reserve liabilities were $1.279B by August 2023, up from the $1.270B in July 2023 with SDR balance available for use dropping from $125M to $76M by end of August 2023 while Banks’ deposits in fresh dollar increased to $14M and the public sector deposits in fresh dollar expanded from $275M to $328M by end of August 2023.

BDL Total, Foreign assets and Currency in Circulation by mid of September 2023 ($B):

Source: BDL, Blominvest

Disclaimer

This article is a research document that is owned and published by Blominvest Bank SAL.

No material from this publication may be modified, copied, reproduced, repackaged, republished, circulated, transmitted or redistributed directly or indirectly, in whole or in any part, without the prior written authorization of Blominvest Bank SAL.

The information and opinions contained in this document have been compiled from or arrived at in good faith from sources deemed reliable. Neither Blominvest Bank SAL, nor any of its subsidiaries or affiliates or parent company will make any representation or warranty to the accuracy or completeness of the information contained herein.

Neither the information nor any opinion expressed in this research article constitutes an offer or a recommendation to buy or sell any assets or securities, or to provide investment advice.

This research article is prepared for general circulation and is circulated for general information only